Complete the Form Today in 3 Minutes or Less

No matter your credit score, Loanza could help you get the $1000 loan you want today.

Complete our fast and simple online form to get connected with a suitable lender from our network in minutes.

Requesting a loan using the Loanza service won’t have an effect on your credit rating.

How can I request a $1,000 loan using Loanza?

Finding a $1,000 loan with the help of Loanza couldn’t be more straightforward. We’ve created a three-stage process to help.

Submit your application

Complete the simple form today and we’ll connect you with one of our lenders.

Instant Decision

In just minutes from now, you could have a decision on your screen from a lender.

Get your $1,000

If the lender approves, you can check the loan terms, sign, and receive your requested $1,000 direct into your checking account!

What eligibility criteria do I need to meet to get a $1000 loan?

There are a few simple criteria you may need to satisfy if one of our lending partners is going to consider you for a $1000 loan:

- You must be at least 18 years old

- You’ll need to earn a minimum of $800 per month, and enough to affordably make the repayments on a loan

- You need a checking account to receive the funds and make the repayments from

- You must be a US citizen

What if I have bad credit? Does it mean I can’t request a $1000 loan?

Don’t worry – Loanza’s wide-ranging panel of lending partners means that we have connections to lenders who cater to people like you. When you search for a loan via our service, it doesn’t matter if you’ve got a bad credit history.

You can still request a $1000 loan as the lenders focus on whether you can comfortably afford the repayments on that loan. If you can prove you’re regularly paid enough to cover the loan repayments, they’ll consider you for a $1000 loan.

Furthermore, if you do get a loan and you’re consistent and conscientious with your repayments, it could help improve your credit score, making it easier to get better rates on loans in the coming years.

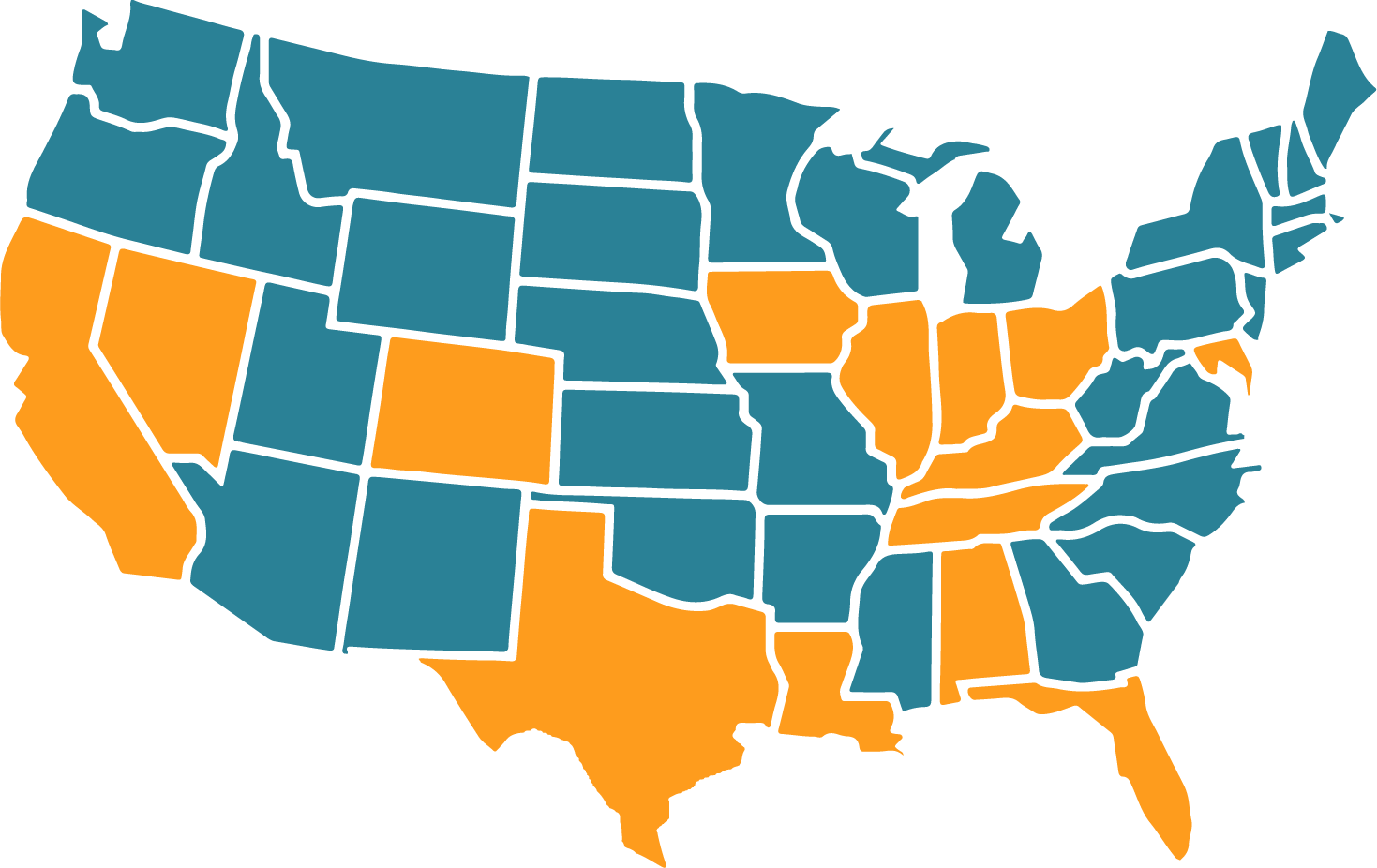

Can I get a $1,000 loan no matter where I live in the US?

If you live in a US state that allows payday loans, you can search for a loan with Loanza. In some instances, a state might limit the interest rate or the amount you could borrow. In those cases, we’ll always adhere to the current legislation in place.

If you live in Kentucky, Maryland, California, Colorado, Alabama, or any of the other states currently allowing payday loans, you can use our service.

We’re not currently able to service those living in New York, however, nor can we assist if you live in another state that currently prohibits payday loans.

Can I bypass the credit check process and get a no credit check $1000 loan?

Loanza was created with you in mind. We want our service to help everyone searching for the ideal $1,000 loan. However, if you receive a quote and you want to make a formal loan request to a lender, they’ll usually conduct a credit check to make sure you’re a suitable candidate.

What makes Loanza the ideal place to search for a $1000 loan?

We’ve taken the time to create a network of trusted lending partners, all specializing in lending amounts to people like you. If you’re looking for a $1000 loan, you can trust us to search our lending panel to see if we can find you a competitive loan for that amount.

We’ve developed a high-tech online form that takes you just a couple of minutes to complete. We’ll then take that information and focus on finding a lender who can meet your requirements. You’ll get the facts on screen in minutes, and you can decide whether to go ahead and make a loan request with them.

You won’t pay anything to use our service either. You’re never obliged to continue and request a loan, even if you seek a $1000 loan using our search facility.

Frequently Asked Questions

I want to look for a $1000 loan. Is there anything I should think about first?

The major question revolves around affordability. Do you know how much income you receive each month, and how much of that income is already taken up with outgoings? Make sure you know the figures. Once you know how much surplus cash you’ve got, set some of that aside to cover anything unexpected that might occur. You can then find out whether you’re able to afford the repayments if you get a $1000 loan.

Do I need to pay you to use your service?

No – Loanza is absolutely free and always will be! We don’t hide any fees either – you can use our two-minute service to connect with a lender who may be able to offer you a sensible and affordable $1,000 loan. It’s then up to you to read the terms to decide whether it is the loan you’re looking to take out.

Do you work as a direct lender?

No, the idea is that we’re a link between you and the lenders. This means we might be able to connect you with a direct lender. Our service is designed to help connect you to the most appropriate lender for your requirements. Thousands of people have already used our service to find an offer that fits their needs.

How much will I actually pay back on a $1000 loan?

A typical loan incurs an interest rate, and this may vary from one lender to another. The higher the rate, the more a loan would cost. The other important factor is how long you might take to pay back the loan. You may pay less in interest if you repay it over 12 months rather than 60, for example.

It’s wise to do some figures using a loan calculator before you consider taking out any loan from any lender. Keeping the loan term as short as you can, while finding a competitive interest rate, is the best path to take. You should still make sure you can afford the repayments, however.

Can I repay the whole loan earlier than I intend to?

A loan is taken out according to a term, which might be anything from 1 to 60 months. You should read the conditions for a loan before agreeing to it, as there could be a fixed or minimum term. If you want to repay your loan earlier than this, you may incur an early repayment fee. Your lender will be able to tell you more about this.

What happens with my $1,000 loan repayments?

You’ll make one repayment a month from the same account you receive the loan amount into at the beginning. The terms are set with your lender, so they’ll be able to give you the details. Your payment date will be the same each month, typically occurring just after you receive your income for the month.

What should I do if I can’t make one of my repayments on time?

If you know this might happen, get in touch with your lender. They might be agreeable and allow you to make a later payment on that occasion – but this is only possible if you call them in advance. Be aware that missing a payment is likely to lead to dropping a few points on your credit score, and it could harm your ability to get credit in the future. The missed payment would also be marked on your credit history.

Our Latest Guides

Need a $1000 loan?

Contact us today to find out how we can help you.