3 Minutes is All it Takes to Complete Our Form

Even with a bad credit score, we could assist you in sourcing a $600 loan.

Our form could help you connect with a suitable lender in moments from now.

Your credit score isn’t at risk if you submit a request for a loan via our service.

I need a $600 loan. Where do I start?

We offer three steps that could take you closer to the $600 loan you need. We’ve created a simple process to reduce the time it takes to find a suitable loan.

Answer some simple questions

Our form helps you connect with a suitable lender.

Fast, instant decision

It can take as little as a few minutes to find out whether you can get your loan.

Receive your $600

If a lender approves you, you just need to read their terms, sign on the dotted line, and wait to receive your $600 straight into your account.

What criteria do I need to meet to get a $600 loan?

There are a few simple requirements you’ll need to fulfil to find a loan via the online Loanza service:

- You’ll need to be at least 18 years of age

- You must be a US citizen

- You must prove you can afford to repay your loan each month

- You need to have a checking account to receive the funds

Can I request a $600 loan with a bad credit history?

Yes, you can! We’ve made sure our service is ideal for everyone, including those who have a bad credit score. We’ve put together a wide panel of lenders.

When you request a loan, we’ll connect you with a lender that will most likely approve you. They focus on whether you can afford the repayments on your loan. It’s not just a case of considering your credit record.

If you’re able to prove you’ve got a regular income that’s large enough to cover your repayments, you could find it’s rather easy to get a $600 loan online with our help.

Can I borrow $600 from a lender in any US state?

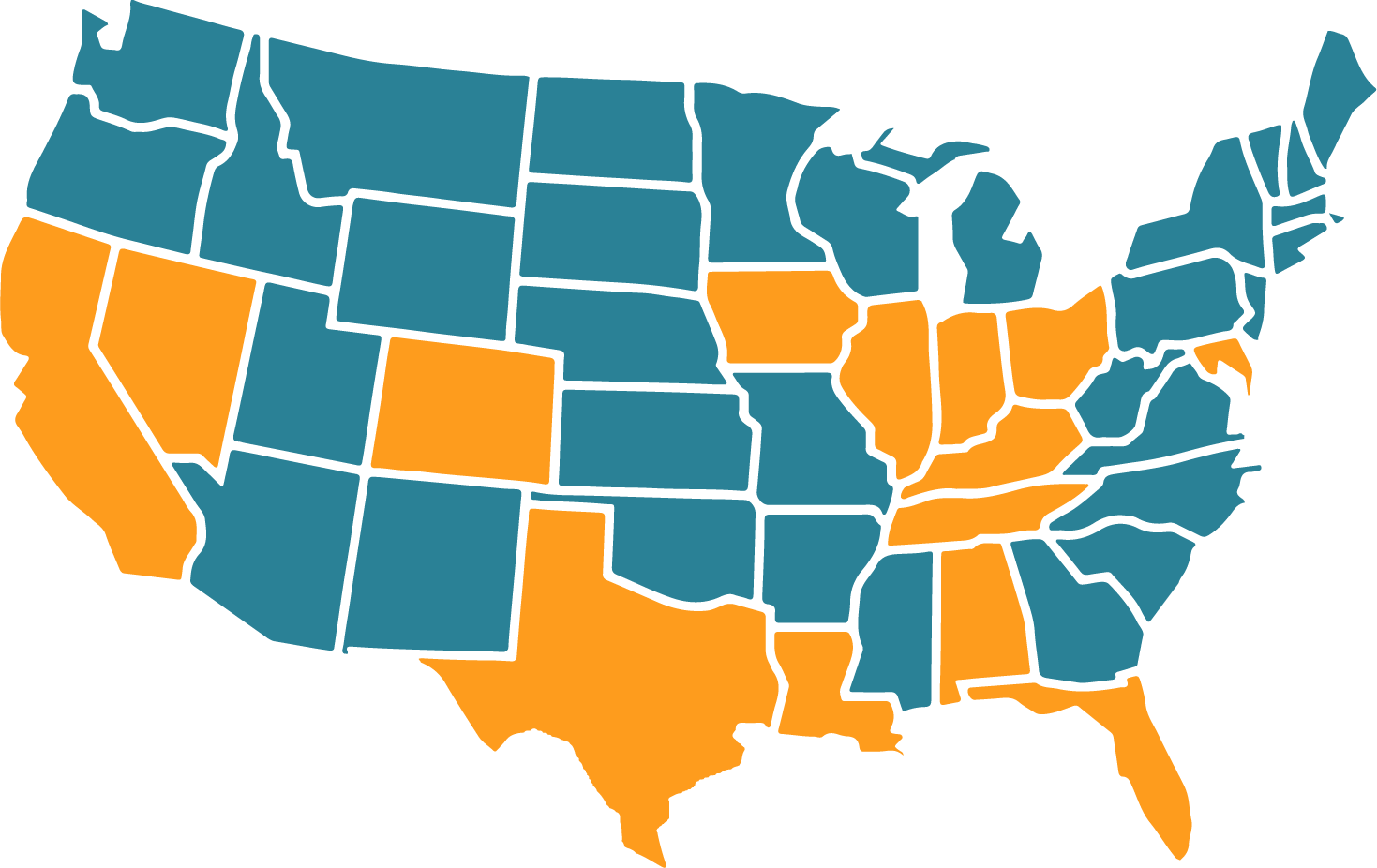

Laws are different from one state to the next, even if they’re next to each other. We abide by all laws, which means we may be able to supply quotes from payday lenders in some states and not others.

Other states might have a limit on the amount you could borrow, or on the amount of interest you might pay.

Many states, from Alabama to Maryland, allow us to offer our services to people in those areas. If you’re not able to request payday loans where you live (such as in New York State), you won’t be able to request them via our service.

Can I get a loan for $600 with no credit check?

Our aim is to connect as many people as we can with lenders best suited to their needs. Loanza provides quotes for you using a process that involves lenders running a soft search.

This has no effect on your credit score, protecting it at this stage. If you receive a quote for a $600 loan and you decide you’d like to request it from a specific lender, this is the stage when a full check will happen. The lender should make this clear, so you know where you stand.

Why is Loanza a great choice for finding a $600 loan?

We have connections to many lenders in our panel, catering to individuals from all walks of life. Good credit or bad, high loan amount or low… whatever is relevant for you, you could save time trying our online service.

Spend just a couple of minutes filling in our form now. We’ll then take over and send your request to our panel of lenders. We’ve got connections to lenders who offer their loan services to people just like you.

We’ll then come back with details of a potential lender, including interest rates and terms, so you can see what you think. We charge nothing for our service, and you won’t need to go for a loan unless you want to. Our form’s right here, so begin now!

Frequently Asked Questions

Will I pay to use the Loanza service?

No, not a dime. Our service is free and always will be. We provide a search facility, so you can save time by giving us your details and we’ll head off and do the hard bit of finding a lender who might be able to help.

You can then decide whether to request that $600 loan from one of our lenders. If you do, check the details of their interest rates and potential fees first. You’ll then get the complete picture before you sign on the line for a $600 loan.

Do you lend money?

No, we don’t. It might be best to think of us as a connection service – we’re positioned between you and a large panel of lenders. Instead of approaching various lenders individually, you’re able to use our service to approach everyone in our panel in one go. Thousands of individuals have requested loans after using our online form, and you could be next in line.

How much will a $600 loan cost me in total?

There are two elements to remember here. The first involves the number of months you want to take to repay the amount. If you can repay it over fewer months, you’ll likely find it cheaper.

The second involves the interest rate. This could vary according to multiple factors, such as your credit history and the time you want to have the loan for.

Loan calculators are useful to figure out the differences. You can tweak the length of time and possible interest rate before you do anything else.

Lenders should provide clear details of the term and the interest rate before you agree to any loan.

What do I need to do to make repayments on the $600 I’d like to borrow?

One repayment will leave your account each month. You’ll know the date before you go ahead with a loan, but it should always be after you receive your earnings each month. The payment goes out automatically, as the lender will have your checking account details and will arrange this for you.

Can I clear my loan balance early?

Lenders have different rules on early repayment of a loan. Check first to find out whether you can clear any remaining balance early. There could potentially be a fee for doing this, which might mean it could be better to make the remaining monthly payments as previously agreed. Your lender should provide these details before you choose them.

What happens if I can’t make my agreed repayments?

Talk to your lender. Late payments may have two effects – they could lead to extra fees charged on the $600 loan, and they might also damage your credit history. Speaking to the lender could give you a chance to avoid these, if there’s a good reason why you might be late with a repayment. Whatever you do, don’t ignore it.

What else should I consider before looking for a $600 loan?

Use a loan calculator to work out what you could afford for the repayment each month. Adjusting the term could change the repayment amount but remember a longer term could mean you repay more over the loan’s life. Make sure you need $600 too; you might be able to manage with a smaller sum, depending on what you’re using the money for.

Our Latest Guides

Need to borrow a $600 loan?

Contact us today to find out how we can help you.