It takes just 3 minutes to complete our form

Loanza could help you get a $3000 loan, even if you’ve got a low credit score.

Complete our form online today and we’ll connect you with a reliable lender.

Requesting a loan via our service won’t affect your credit rating.

What do I do to get a $3000 loan?

You can use our three-stage process to easily look for a $3000 loan via Loanza.

Submit your details today

Fill in our straightforward form online and we’ll connect you with a lender.

Instant Decision

It could take just minutes to receive a decision from a lender.

Receive your $3,000

If approved, read the terms, sign where required, and wait for the $3,000 to arrive in your account!

Which criteria do I need to meet to borrow $3,000?

You may find you need to meet these criteria if you wish to request a $3,000 loan:

- Aged at least 18 years old

- A US citizen

- Able to prove you can afford to make the monthly repayments

- Have a checking account (required for the lender to deposit your funds into)

I’ve got a bad credit history, can I still borrow a $3000 loan?

Yes! Loanza is designed to help everyone seek the loan they’re after. You can request a loan for $3,000 regardless of your credit record. We’ve made sure our panel of lenders caters to everyone, even those with bad credit. Our lenders consider affordability, so if you can afford to repay your loan, you’ll be considered along with everyone else.

If you get a $3,000 loan and can meet all the monthly repayments on time, it could even enhance your credit score. This might lead to an easier time looking for loans in the future.

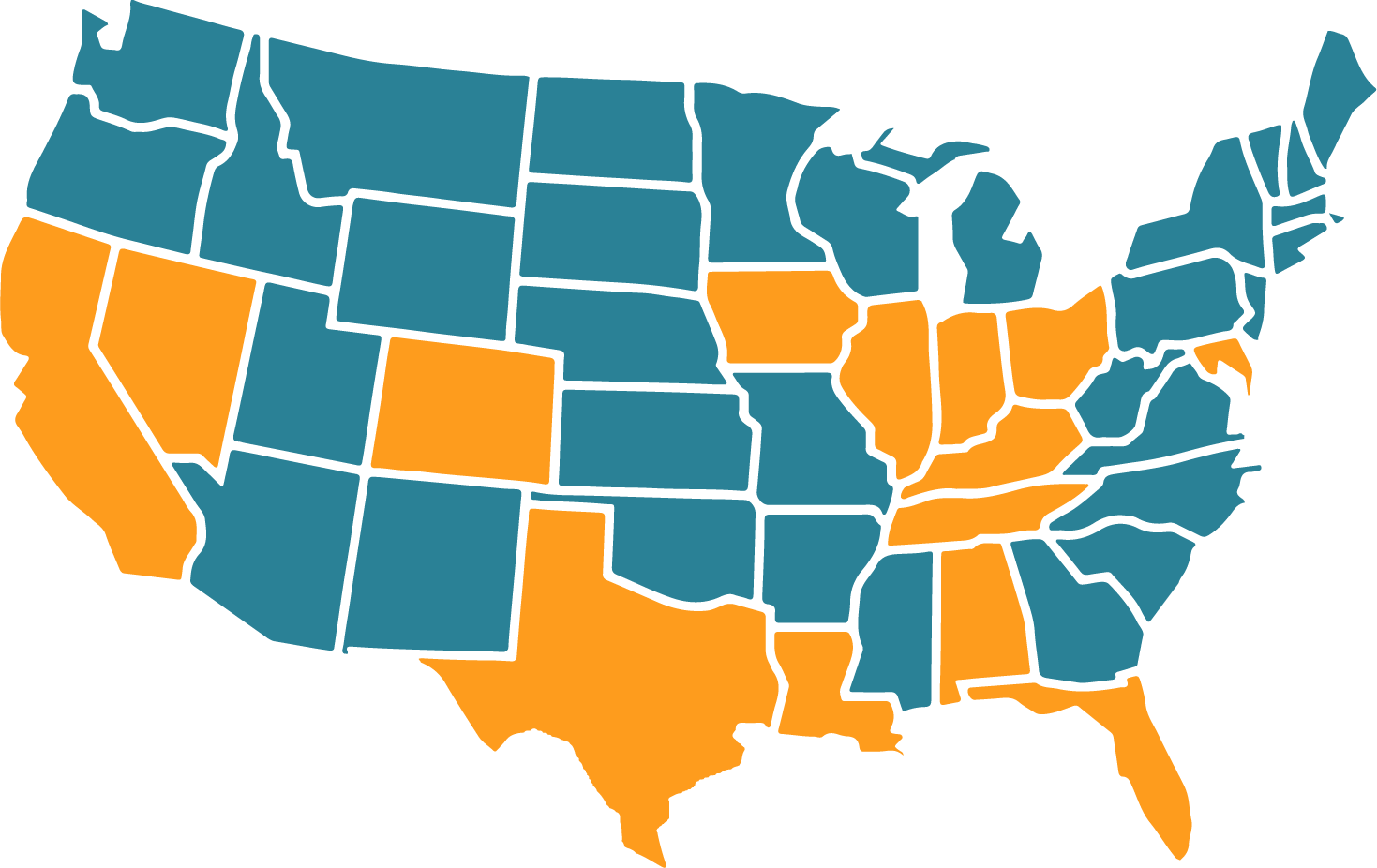

Does it matter which state I’m in if I’m looking for a $3000 loan?

Loanza is delighted to provide our service wherever we can. If a state allows us to offer payday loans, we’ll be there for you. There are limitations in some states, relating to the loan size in some cases and interest rates in others.

We currently operate in Florida, Illinois, California, Kentucky, and Louisiana among many. If you live in a state that doesn’t allow payday loans (New York state being one), you won’t be able to use our service.

Do I need to go through a credit check to get a $3000 loan?

We’re aware that lots of people search online for no credit check loans. Loanza was created to assist everyone, even those looking to bypass the credit check process. If you decide to request the loan we connect you with, you’ll usually need to go through a credit check as the lender considers your request.

What makes Loanza a smart choice to borrow $3,000 online?

With many trusted lenders in our network, we can connect you to the most suitable one when you want to borrow $3,000 with the least hassle and inconvenience. Our powerful system is designed to use your details to connect you to a suitable lender in minutes.

Take two minutes to complete our form, then wait for our system to do its work. We’ll connect you, so you can read their terms and decide whether to request that loan.

You won’t pay a dime to use the Loanza service, and there’s no obligation to press ahead with the quote we bring you. You’re always in control with Loanza.

Frequently Asked Questions

How much does it cost to get a $3000 loan?

With any $3,000 loan, to calculate the cost, you need to factor in the interest rate charged on it. You can work out your monthly repayments using an online calculator before looking for a loan with Loanza. Bear in mind that a longer term may lead to lower monthly repayments, but you’ll repay more over the lifetime of the loan.

What should I think about before looking for a $3000 loan?

Affordability is the most important thing to consider at this early stage. Can you afford the monthly repayments if you were to get a $3,000 loan? You can repay between one and 60 months, so it’s a sensible idea to look at the likely term that could work best for you. As we noted above, longer terms do mean repaying more in interest, along with dropping the monthly payment you’ll need to meet. Make sure you look at your income and outgoings, so you can work out how much spare cash you have left to work with. Never go to the limit when you’re considering how much you could afford to repay on your $3,000 loan each month. There could always be unexpected expenses or bills to pay elsewhere, so you need to be sure you’ve got some surplus cash after all your current bills and the repayment on a $3,000 loan is made.

Are you a direct lender?

No, we connect you to one of the direct lenders in our network, rather than supplying loans ourselves. Our experience in the market means we can regularly connect borrowers like you with trusted lenders online today.

How much do I need to pay to use Loanza?

You won’t pay us anything – our search facility is free. This means you’ll be able to connect with a suitable lender, so you can see what terms they offer for the $3,000 loan you’re looking for. Make sure you read their terms carefully and consider the interest rate and other factors before taking out a $3,000 loan with them.

Would it be possible for me to repay the loan earlier than agreed?

This is often possible, although some lenders do have terms that include an early repayment fee in such cases. You may also find you need to agree to a minimum term. Your loan details will confirm such instances, and you should read them before taking out a $3,000 loan with any lender.

What do I need to know about the monthly repayments on a $3000 loan?

If you agree to a loan with a lender, they’ll let you know which date each monthly payment will leave your account. They should arrange this for a few days after your monthly earnings land in your account. You’ll pay the same sum every month.

What should I do if I can’t make the repayments?

Contact your lender as soon as you can. Most lenders are ready to assist in these circumstances, and you might be able to arrange to make the repayment later that month. If you don’t contact them, they’ll likely charge a late repayment fee. You may also see your credit score drop by a few points as the late payment shows on your file.

Our Latest Guides

Need a $3000 loan?

Contact us today to find out how we can help you.