Complete Our Simple Form in Minutes!

Loanza could assist you in finding a $500 loan, no matter what credit score you have. Complete our online form and we could connect you with a trusted lender in minutes. Requesting a loan using Loanza does not have any effect on your credit rating.

How can I get a $500 loan?

Finding a $500 couldn’t be simpler if you choose Loanza. Our three-step process makes it faster than ever to complete right here.

Submit Your Details and Apply Online Today

We could connect you with a lender once you’ve completed our straightforward form.

Quick Decision

A decision could be minutes away for you. See which lender is right for you.

Receive Your $500

If you receive approval, you just need to check the terms of the loan, sign the loan agreement, and receive your funds direct into your bank account!

How do I know if I’m eligible for a $500 loan?

If you’d like to try and get a $500 loan via Loanza, you may find you need to tick off a few criteria as shown below:

- You’ll need to be aged at least 18 years

- You’ll need a checking account so you can receive the $500 directly into your bank account

- You must be a citizen of the United States of America

- Your monthly income must be at least $800

Do I need to go through a credit check to apply for a $500 loan?

We are dedicated to helping as many people as possible find the right loan for their needs. At Loanza, we understand that many people are searching for loans with no credit check required.

You may find you could search for loans without going through the credit check process, or at least that only a soft check is used. This wouldn’t affect your current credit score.

However, if you decide to go ahead and make a proper loan request to a lender for a $500 loan, the lender will usually perform a full credit check to make sure you meet their requirements.

I’ve got a bad credit score. Do I still have a chance of borrowing money with a $500 loan?

Absolutely! Our service at Loanza is designed to assist everyone, no matter whether they have a good or bad credit score. We have access to a large series of lenders, which means you could have more possibilities here than you may find elsewhere.

Some of our lenders cater to those with excellent credit, while others aim to help borrowers with bad credit. They serve borrowers who come from a vast range of backgrounds. Rather than focusing solely on your credit history, they look at your affordability status too.

You can rest assured you’ll be considered along with everyone else, provided you have a regular income that is reliable, and that you can comfortably afford to repay your loan.

Even better, you may find your credit score gets a boost if you can borrow the $500 and meet all your repayments on time. This could open the way for a chance for more competitive loans to come if you need them.

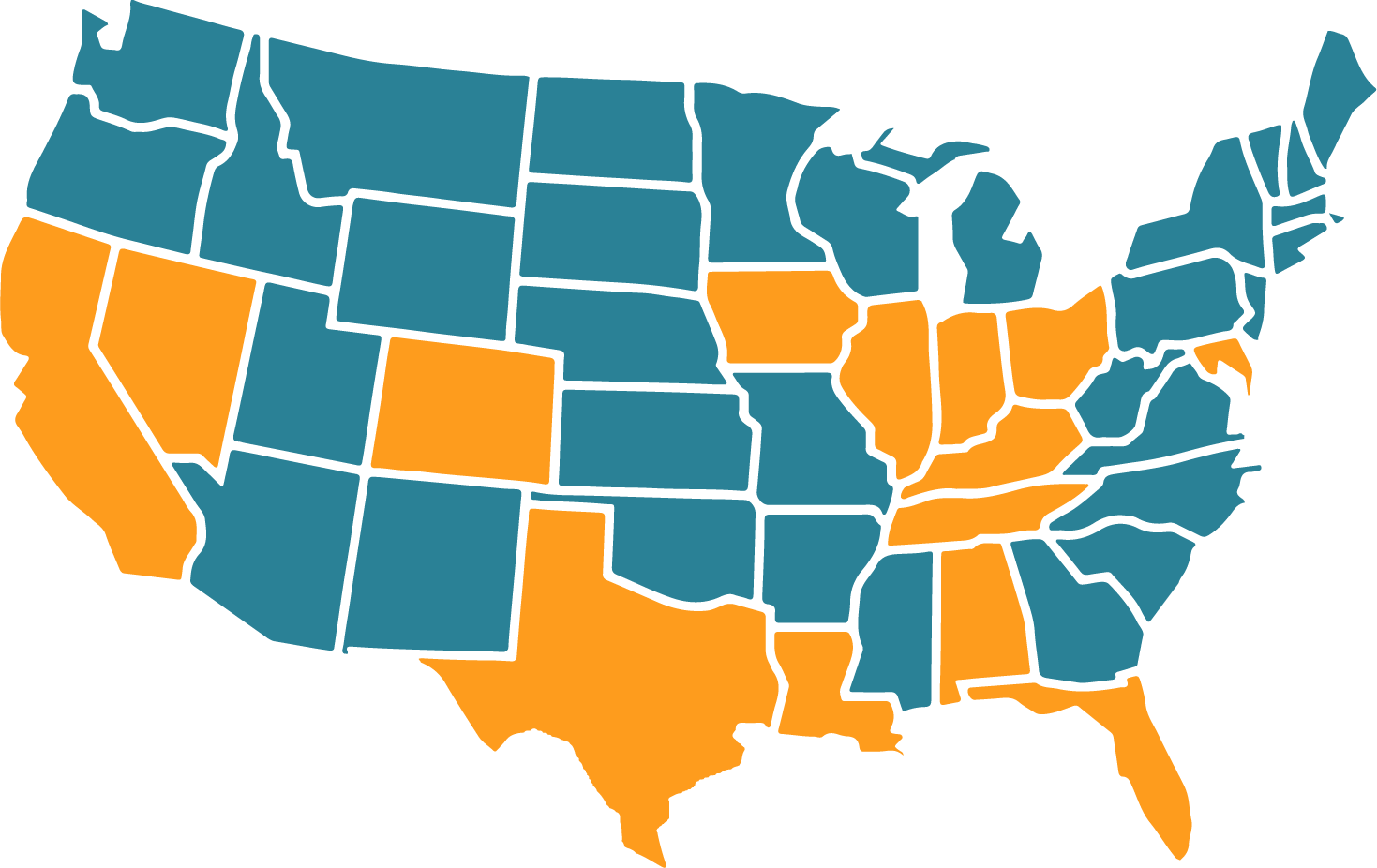

Do I need to be in a specific US state to receive one of these $500 loans?

Loanza strives to provide our service in as many states as we possibly can. If a US state allows us to offer payday loan services, you can apply for them here with us. Some US states have introduced legislation to limit the sums that might be available; alternatively, there may be limits on interest rates.

The good news is that if you live in states where such loans are allowed, you could apply via our site today. Such states include Kentucky, Maryland, Colorado, Florida, Alabama, and Iowa. As we want to abide by all relevant laws, we cannot provide our services in states that do not allow payday loans. These currently include New York.

What should I think about prior to making a $500 loan request?

The major point to think about is whether you can afford to cover the monthly repayments. Begin by looking at how much you’re paid each month, and then make sure you’ve got enough left to meet the repayment and have plenty to spare.

You should never go up to the limit of your income – always be sure you’ve got spare cash to cover emergencies. Remember too that while you can pay less each month with a longer term for your $500 loan, you’ll pay more in the end over the life of the loan.

Why borrow $500 online via Loanza?

We’ve worked hard to build a network of lenders who cater to people with all kinds of backgrounds, credit histories, and loan requirements. You may already know there are plenty of loan options out there.

You may well find that looking for a $500 loan via Loanza could be easier and more convenient than ever. We could connect you with a suitable lender ready to consider you for that loan.

It takes just two minutes to complete the form required to allow our high-tech service to go off and find a lender who may suit you.

With no cost for our services, no delay, no obligation to continue, and zero hassle, you could try us today to see whether your $500 loan is around the corner.

Frequently Asked Questions

Is Loanza a direct lender?

No, we’re here to help connect borrowers with lenders. Our system is designed to help connect you with a lender that most closely fits your needs. We’ve already done this for thousands of other people, and it’s something we could do for you as well.

Is the Loanza service free of charge?

Yes! We never charge you any fees for searching for loans via our service. If we connect you with a suitable lender and you make a loan request, you may find there are interest rates and fees attached, so read everything thoroughly before you go for a $500 loan.

Is there a chance I could repay the loan ahead of the end date?

This could be possible, yes, but you’d need to talk to your lender to see how this works. In some cases, early repayment incurs a fee. Alternatively, minimum terms sometimes come into play.

How much will I pay for a $500 loan?

The answer depends on the amount of time you take to repay it and the applicable interest rate on the loan. The shorter you can get the loan term, the better, and obviously a lower interest rate will lead to a cheaper loan too.

You could use a loan calculator to come up with the exact figures for your scenario, according to the loan amount, term, and rate. Make sure your lender supplies this information as well, prior to signing any loan agreement.

How do I manage the repayments on a $500 loan?

These occur automatically, with the money leaving the bank account you give details for on your loan request. You should pay identical amounts monthly, typically a few days later than the date you’re paid each month. You’ll know all this ahead of time, so you know what to expect.

What happens if I end up missing a repayment?

This may incur a fee, depending on the terms of your loan. Late payments are also recorded on your personal credit file, so your credit score will be lower as a result.

If you ever run into issues and think you might not be able to make a payment on time, speak to your lender before that happens. There could be a chance to pay later by agreement, which could save you from paying fees and damaging your credit score.

Our Latest Guides

Need to borrow $500?

Contact us today to find out how we can help.