Complete Our Form Today in Under 3 Minutes

Loanza is ready to help you get a $2000 loan, regardless of your credit score.

Fill in our quick and easy form online and we’ll connect you with a suitable lender.

Using the Loanza service does not have any effect on your credit rating.

How can I borrow $2,000?

Getting a $2,000 loan using Loanza is quick because of our three-stage process.

Submit your loan request

We could connect you with a lender in moments once you’ve completed your form.

Instant Decision

It can take just a few minutes to receive a decision via a lender.

Get funded

If a lender approves you, check the terms of the loan, sign as required, and wait for your $2,000 to arrive in your account!

What do I need to do to borrow a $2000 loan?

You may find you need to tick a few eligibility boxes to be able to request a $2,000 loan via Loanza. Can you say yes to all of the following questions?

- Are you a US citizen?

- Are you at least 18 years of age?

- Do you have a regular monthly income to enable you to meet the monthly repayments?

- Do you have a current account so you can receive your loan?

If I’ve got bad credit, can I still request a $2000 loan?

Yes! We’ve designed our service to make sure we can cater for everyone searching for a loan. So, if you do have a bad credit score, don’t worry.

You can still make a request for a suitable loan with Loanza. We’ve compiled a panel of lenders who cater to all kinds of people in all walks of life.

If past issues have led to a poor credit history, we may still be able to connect you to a lender who might consider you for a loan. If you’ve currently got a stable monthly income, they’ll look at the possibility of meeting your needs.

If you do borrow $2,000 via Loanza and you can keep up with the monthly repayments, you may well find your credit score gets better. This can make it easier to request a better loan next time.

Where does Loanza provide people with $2,000 loans?

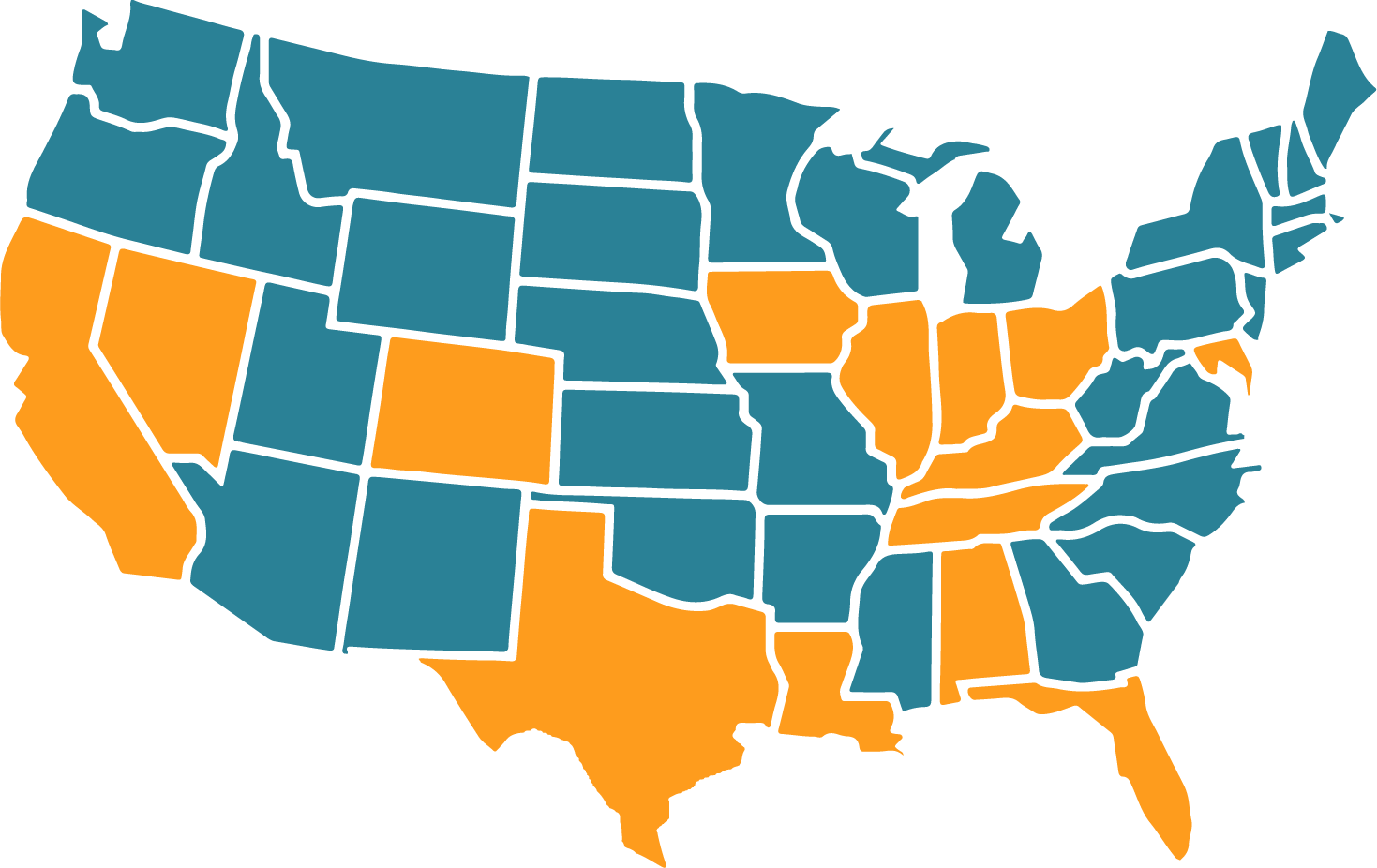

We can provide $2,000 loans in 37 US states – the ones that allow lenders to offer payday loans. Texas and California are among the states that do, but New York currently does not.

Our system is designed to let you know whether you could search for a $2,000 loan in your area. In some cases, amounts are limited, while other states might limit the interest on a loan.

Must I go through a credit check to get a $2000 loan?

We know lots of people search for no credit check loans. You could use our search facility to get connected with a lender using the details you give us.

However, if you decide to request the loan from the lender, you will typically need to pass a credit check carried out by them – this should be communicated to you clearly beforehand.

What makes Loanza a smart choice for helping you find a $2000 loan?

There are so many lenders around today, finding one to suit your needs is tricky and time-consuming. That’s where we come in, bringing you a chance to access our network of reliable and experienced lenders catering to all requirements.

We could connect you with one of our lenders in just a few minutes. Our form takes a couple of minutes to fill in, and then our system does the rest.

We’re free too, so it doesn’t cost you anything to see what’s out there if you’re searching for a $2000 loan.

Frequently Asked Questions

Do I have to pay anything to use Loanza?

No, we’re always free to use – it costs nothing to complete our form, other than a couple of minutes of your time! Once you’ve done that, you can leave it to us to search for a trusted lender and to connect you with them. You’ll soon have the details you need to help you decide.

Are you a direct lender?

No, Loanza doesn’t lend money – instead we act as a connection service, connecting you with one of the direct lenders in our network. Thousands of people visit our site daily, looking for a loan offer.

How much will I pay to get a $2000 loan?

You need to know the interest rate and the length of time the loan lasts for to work out the total cost involved for your $2,000 loan. The rule of thumb is to go for the lowest possible rate of interest and to repay it over the shortest term. The best way to work out some figures is to look online for a loan calculator that helps you work out what’s involved with a payday loan.

What should I think about before requesting a $2000 loan?

It’s essential to know what you can afford to repay before making a request. Make a note of your income, your outgoings, and allow some of the remaining amount to be set aside to cover emergencies. Whatever remains at this stage could be used to meet your repayments on a $2,000 loan. You could then use a loan calculator to adjust the repayment period and the interest rate to get an idea of what you could afford. Remember that the longer your loan period lasts for, the more you’ll repay over the life of the loan, even though the repayments will be smaller each month.

Can I clear my loan repayments earlier than the agreed end date?

Oftentimes it’s a possibility, yes, although different lenders may have different approaches. Some impose a minimum agreed loan term or charge a fee for clearing the loan early. You can find out about these before taking out a loan, though – just check with the lender.

What happens with loan repayments?

If you take out a $2,000 loan with a lender, they’ll tell you the monthly date on which repayments will be taken from your account. You’ll pay the same each month and it will usually occur a few days after your earnings land in your account.

What should I do if I know I won’t be able to make a scheduled repayment?

Many lenders charge late payment fees, so it is vital to make every repayment on time to avoid these. Moreover, they could also appear on your credit report. Late or missed payments could harm your overall score, making it more difficult to get a loan in future. If you know you’re going to struggle to make your monthly repayment on the $2,000 loan, speak to your lender straightaway. They’ll often be able to help you work something out if you’re honest with them. This could avoid the fees and credit score damage you’d otherwise incur.

Our Latest Guides

Need a $2000 loan?

Contact us today to find out how we can help you.