Complete Our Form in Under 3 Minutes

Loanza could assist you in searching for an $800 loan, even if you’ve got a poor credit score.

Fill in our fast and simple form online and we could connect you to a lender within moments.

If you request a loan via Loanza, your credit rating will not be affected.

How could I request an $800 loan?

We’ve created a three-step process that makes borrowing an $800 loan incredibly simple.

Submit Your Details

Complete our straightforward form online today to get connected to one of our experienced lending partners.

Speedy Process

It could take just a few minutes to receive a decision from a lender.

Get Funded

If you receive the approval you’re looking for, you can read through the terms, sign the loan agreement, and receive your funds!

Why should I use Loanza to find me an $800 loan?

We’ve made sure we’ve got an extensive network of trusted lenders to consider your request for an $800 loan. If you search alone, you’ll spend a long time looking for options, and you could miss some of the options we’ve lined up here.

Our industry-leading technology gives you one easy form to complete, working fast to find the most reasonable loan options in just a few moments. In just two minutes from now, you could connect to a lender who could assist you.

You won’t pay a dime to use our services either. We offer our service free and without obligation, so try Loanza today to see if that $800 loan is out there for you.

What’s the criteria I need to meet to borrow an $800 loan?

If you’d like to request an $800 loan via our service, you may need to be able to tick all the following points:

-

You need to be 18 years or older

-

You must have an income of $800 or more and be able to afford the repayments

-

You’ll need to be an American citizen

-

You’ll need a current account to receive your funds

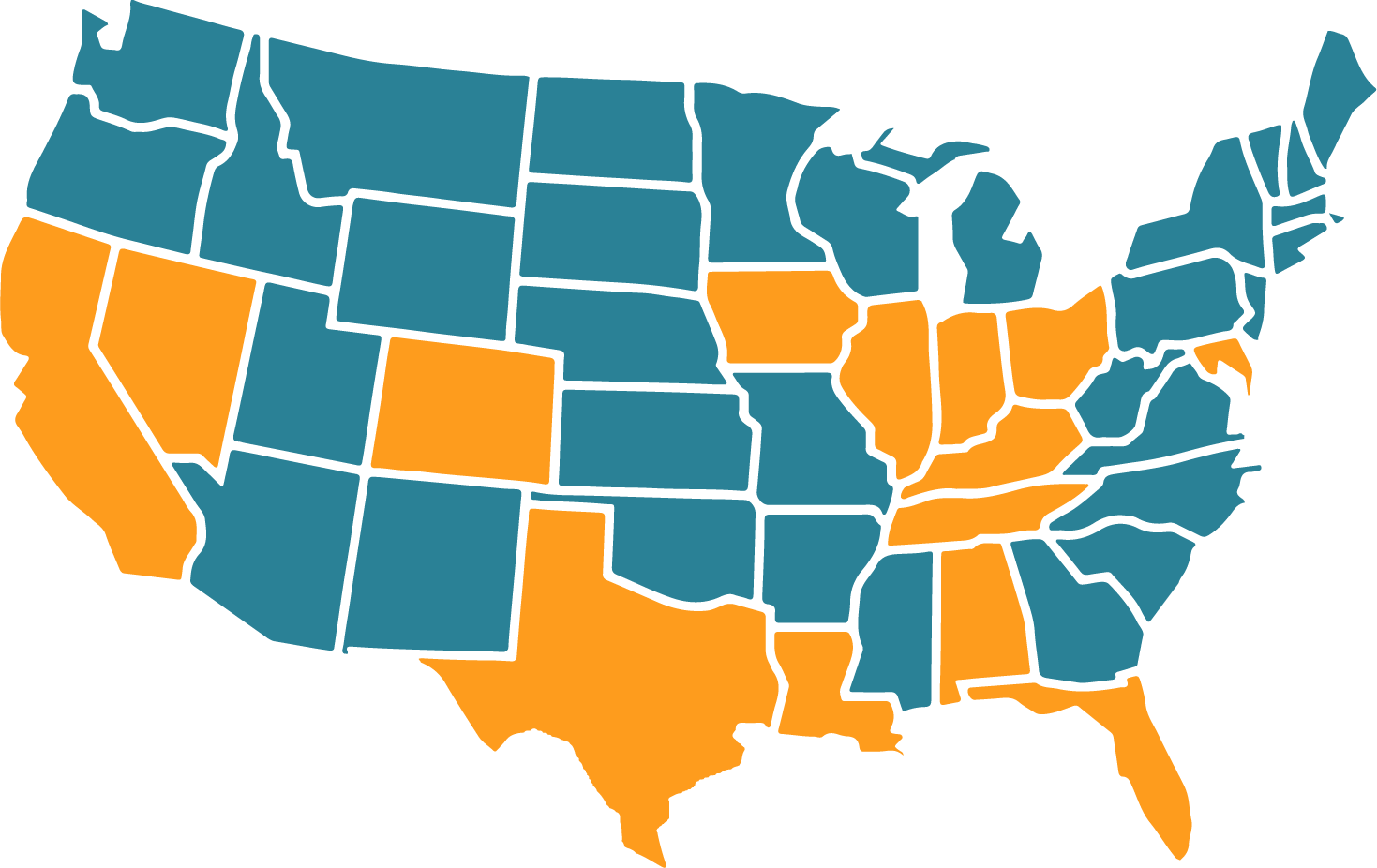

Do you offer $800 loans across all the American states?

If a US state allows payday loans, you can bet we’ll offer our service there. We’re currently offering to connect people like you with lenders in Colorado, Kentucky, Illinois, California, and many other states.

In some cases, states have limits to the lending amount. We also adhere to any rules whereby states limit the applicable interest rate in force. You can trust us to follow all legislation, which means we won’t operate in locations that don’t allow payday loans. New York is a common example of this.

Can I get an $800 loan without going through a credit check?

We’ve created our Loanza service to aid those looking for a loan. We know some individuals search for a no credit check loan, but you should know that if you decide to request a loan from a specific lender, they’re likely to conduct a full credit check on you.

I’ve got poor credit – can I still borrow an $800 loan?

Certainly!

Let us reassure you that even individuals with bad or poor credit scores may still use our service. Even if you’ve had credit problems in the past, you could still request a loan via Loanza.

We have a large panel of varied lenders, each focusing on a specific type of customer, some of whom cater to those with poor credit histories.

Our lenders look at whether you can afford the loan rather than considering your past credit record. If you can prove you have a regular and sufficient income, you’ll be considered for the $800 loan you want.

Better still, if you get an $800 loan and you repay it on time with no missed payments, your credit score could receive a boost.

Our form’s right here, so begin now!

Frequently Asked Questions

How much will I pay for an $800 loan?

The cost depends on how long you’re going to take to repay the loan and the interest rate applied to it. The best way to see how much you might pay for a specific loan is to use a loan calculator. There are payday loan calculators available online, along with other more general loan calculators. The rule of thumb is to try and repay over as short a period as possible and with the lowest rate of interest you can, as this would result in a lower total cost for your $800 loan.

What do I need to do to make repayments on my $800 loan?

If a lender agrees to extend you an $800 loan, they’ll let you know when the first repayment is due. This could well be just after you’re paid each month, but you can confirm the details with the lender before going ahead with the loan. You should also find the amount to pay is identical from one month to the next if you’re on the same interest rate throughout the term.

What should I think about before requesting an $800 loan?

The biggest question is affordability. Could you afford to make the required repayment on time without fail every month for the duration of the term? Before you use our service at Loanza, check your income and note down all your outgoings. How much cash do you have left?

Never attempt to borrow up to the limit of the available cash you’ve got left, as you could need some to meet an unexpected expense. While you could borrow $800 over a longer time, making your repayments cheaper each month, this could result in a higher total loan amount to repay.

Are you a direct lender?

No – Loanza does not operate as a direct lender; rather, we work between you and a group of lenders who provide loans for all kinds of people in all walks of life. By completing our form, you could save time and find a direct lender in a couple of minutes. We’ll connect you to a direct lender that might be able to offer a suitable loan.

Do I need to pay to use Loanza?

No, you’ll never pay to use our service – that’s one of the great things about it! We do not charge you any fees. If we connect you with a lender and you decide you would like to make a loan request to them, you can find out about their interest rate and any other possible fees involved with the loan before you request it.

Is it possible to clear the loan ahead of the agreed date?

Early loan repayment is something lots of people want to know about. Oftentimes, it’s possible to do this, but individual lenders may have different policies in place. Before you sign an agreement for any loan, check whether the lender has a minimum term or whether they charge a fee if you do repay it early.

What should I do if I miss a repayment?

Some lenders charge a fee for a late or missed payment. While mistakes happen, it’s best to be sure you’ve always got enough in your account to meet the repayment amount each month. If you think you might fall short, contact your lender as soon as you can. You might be able to sort something out. If you miss a repayment, it appears on your credit file and could then harm your credit score.

Our Latest Guides

Need to borrow $800?

Contact us today to find out how we can help you.