Borrow money for emergencies including car repairs, home repairs, rent, medical bills and more.

Emergency cash loans are designed for people who need funds quickly. You can use Loanza’s fast search facility to see if we could connect you with a reliable and licensed US lender today. Bad credit considered, borrow up to $35,000 and repay over 1 to 60 months. When it’s an emergency, you don’t want to hang around. With Loanza, it’ll take just 3 minutes to fill in our form and we’ll search our panel of lenders on your behalf. Get started here now!

What is an emergency cash loan?

An emergency cash loan is typically a standard loan offered by lenders who specialize in making sure the loaned amount reaches the person borrowing it as quickly as possible.

In some cases, money can be transferred to your checking account in one hour. All our lenders transfer funds for agreed loans within 24-48 hours, so you’ll never be left waiting and wondering.

How can I tell if I’m eligible for an emergency cash loan?

If you want to request a loan from one of our lenders in the US, you must meet all the following requirements:

- You must be an American citizen

- You must be aged at least 18 years

- You should be able to prove you can afford your repayments each month

- You should have a checking account to receive your funds into

How do I get an emergency cash loan?

Getting an emergency cash loan with Loanza couldn’t be easier, thanks to our fast online form. Complete the three steps in three minutes to begin!

Submit Details

Enter your details as requested on the form – it’s all done online in minutes.

Fast Process

Receive your loan offer in moments and review the terms the lender offers.

Get Funded

If you’re approved by the lender, you’ll see your funds arrive in your checking account – either same day or next! Lenders deposit on business days, so it’s super quick.

How can I find an emergency cash loan near me?

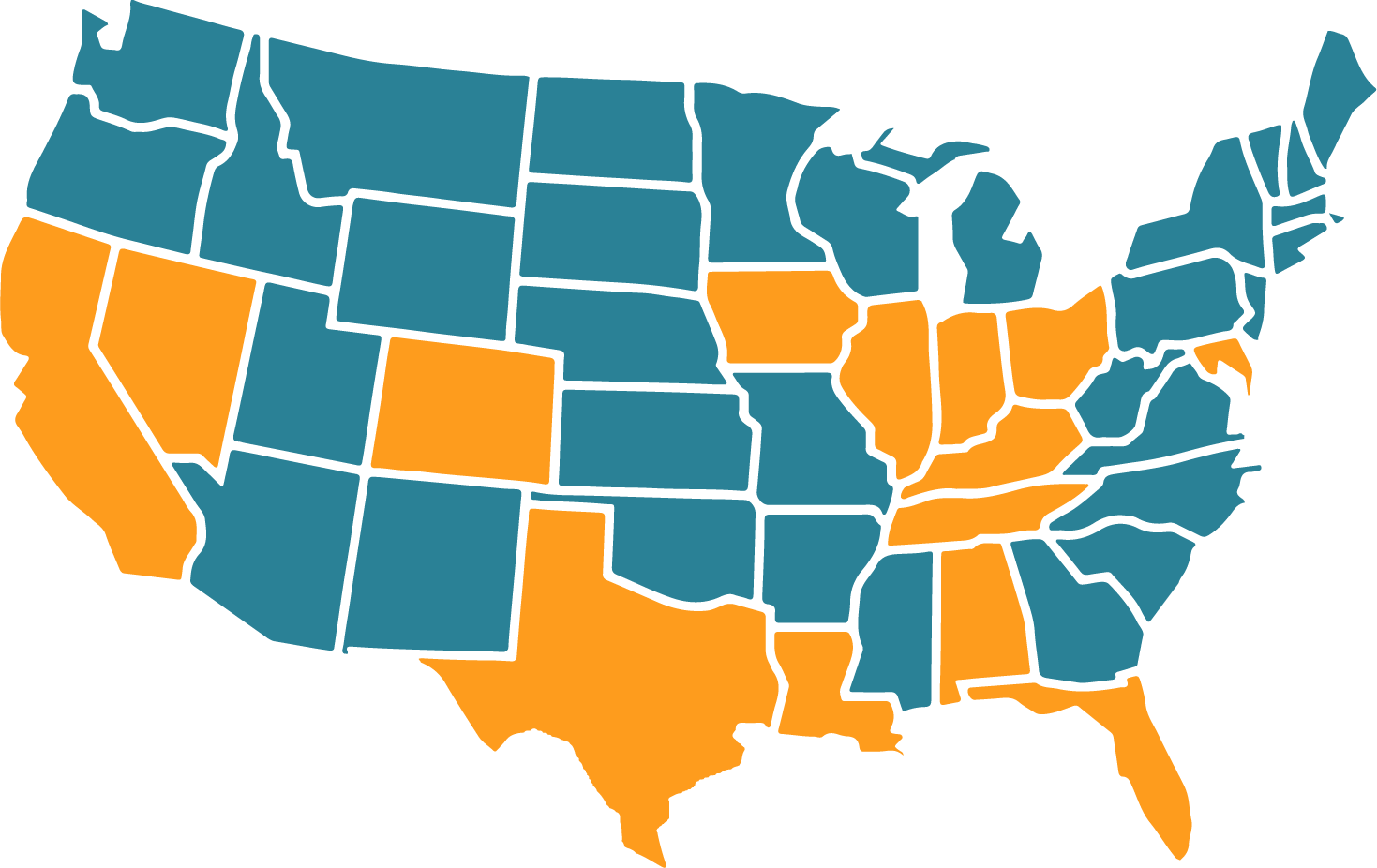

It doesn’t matter where you live in the US, from a major city to a small town. Loanza operates online, so you’re able to use our free search facility to enable us to connect you with a suitable lender.

We’ve got connections to many reputable US lenders – some could be near you and others operate across the US in many states.

Either way, we’ll always bring you a quote from a suitable lender when you need emergency cash loan assistance. Just click any button here and get underway!

Our Promise

Why should I use Loanza to look for and find an emergency cash loan?

We’ve built a network of lenders who are licensed and trusted in their field. They might be able to offer you the emergency funds you’re after today.

- Use Loanza free of charge!

- Fast 3-minute online form

- You could find an emergency loan even with bad credit

- Funding within 24 hours or next working day

- Borrow from $100 up to $35,000

- We could connect you to a reputable, licensed US lender

- Using our search service doesn’t harm your credit score

I have bad credit. Can I still apply for an emergency cash loan?

Yes! We help lots of different people search for loans for all kinds of reasons – including those who need an emergency cash loan. With a wide selection of lenders to look through, we’ll connect you with one who caters to individuals like you.

If you’re in dire straits and you need a loan fast, we could help you find it. Take just 3 minutes to complete our form to kick start the process now.

Can I get an emergency cash loan with no credit check?

All trusted lenders are going to check your credit record while considering you for an emergency loan. Some do hard checks, but many do soft checks only. You should read the details of your loan offer to understand what type of checks the lender will do if you confirm your loan request with them.

Many of our lenders focus on helping those with bad credit, so don’t worry if you’re in this situation. They’ll want to know what you can afford to repay each month and therefore how much you could reasonably borrow. It’s not all based on your credit history.

How quickly can I receive my emergency cash loan?

Speed is obviously important, otherwise, you wouldn’t be looking for emergency funds to start with. We can save you time by searching on your behalf. Complete one form with us in just 3 minutes and we’ll search our network of lenders from all over the United States.

Some customers receive their funds in an hour, with many receiving theirs on the same working day. In other cases, the funds land in their checking account on the next working day, so it’s always super quick.

Loanza’s streamlined and easy-to-use online service makes things way quicker than they would be if you decided to go it alone looking for emergency funds.

Frequently Asked Questions

How much cash can I borrow?

Emergency loans are available from $100 up to $35,000. Loanza could connect you with a lender specializing in loans like these, and they’ll assess your details to see how much they’d approve you for if you formally requested the loan they’re offering.

Are you a lender or a broker?

Loanza acts as a loan connection service. This makes it easier for you to source a competitive emergency cash loan and to be sure you’ve found a suitable lender online. Much easier than searching alone!

Do you charge fees to use your search service?

No, you’ll never pay Loanza any fees.

How long will the repayments last for?

You can decide whether you’d like to spread the repayments over a certain term, with the shortest and smallest loans lasting for just one month and the longest lasting for 60 months (five years).

How do I make the repayments for an emergency cash loan?

You’ll pay one amount on the same date each month. The lender usually sets this for just after you receive the earnings that you’re due for that month. You’ll be given the repayment amount and date before you agree to the emergency cash loan.

What happens if I realize I can’t make a repayment on time?

Don’t panic – and do call your lender. If you don’t do this, and you miss the repayment, it will likely be recorded on your credit file as a missed payment.

This damages your score and could make it a lot harder – and pricier – to get any sort of loan in the future. You may also be hit with a late payment fee.

Contacting your lender means that you might be able to make alternative arrangements to make sure you’re able to stay on track. It could well save you money and hassle while protecting your credit score.

What can I use an emergency cash loan for?

Plenty of people search for emergency cash loans when they need money quickly. There could be lots of reasons for this. It might be because of an unexpected medical bill or maybe a problem with their vehicle that means urgent repairs are needed.

Even if you’re usually on top of your bills and you’ve got a little spare cash around, you can’t foresee everything. Unexpected expenses are typically the reason why someone might want to take out an emergency cash loan.

You shouldn’t use this sort of loan for casual purchases or anything that you can save for in advance, like a vacation or buying clothes, for instance. You should also always be sure you can afford to make the repayments each month on your emergency cash loan.

Our Latest Guides

Need to borrow money?

Contact us today to find out how we can help.