Apply Online and Receive Funds in 1 Hour or The Same Day

Fast cash loans allow you to repay your loan over 3, 6, 12 or even 60 months. Fast cash loan repayments are taken in equal monthly amounts. Loanza helps thousands of bad credit borrowers every day, offering quick funding, within 24 hours or the next business day. Borrowing $100 to $35,000 via a fast cash loan with Loanza is smooth and simple. Get started with your loan application below.

What is a fast cash loan?

A fast cash loan is a loan you could take out for between $100 and $35,000 that could be granted very quickly. With Loanza, you could use our search facility to find a suitable lender that may agree to your request for quick cash.

You’ll usually manage your repayments over 1 to 60 months. It’ll take you just a few moments to complete our form, so we can search dozens of lenders on your behalf.

When you receive a quote, you can check it over, make a formal request, and if approved, you could end up receiving your cash very quickly – on some occasions on the same day.

What are the criteria to get a fast cash loan?

If you meet the following requirements, you could be able to take out a fast cash loan via one of our trusted lenders:

- US citizenship

- At least 18 years old

- Checking account for the lender to deposit your funds into

- Monthly income of at least $800 per month

How to request a fast cash loan with Loanza

Our three-step online process takes just three minutes to complete!

Submit your information

Enter your basic details into our online form – it only takes a few moments.

Instant decision

Get connected to one of the trusted lenders we work with. They’ll provide a loan offer you can check out here online for convenience.

Get funded

If the lender approves your formal request for a fast cash loan, you could receive your funds directly into your checking account on the same day orr next business day. Super quick and simple!

What makes Loanza the ideal choice to help me find fast cash loans?

We’ve created a large network of lenders from all over the US. We only work with reliable, trusted, and qualified lenders who could offer you a fast cash loan.

Our online search system uses your information to perform a quick search that doesn’t affect your credit history. Within moments – and in the comfort of your own home – you’ll be connected with a lender who could provide you with the fast cash loan you’re after.

- Loanza is free!

- Complete our three-minute straightforward online form to begin

- Bad credit customers considered

- Get funded in less than 24 hours or the next business day

- Borrow from $100 up to $35,000

- We’ll only connect you with trusted US-based lenders

- You won’t harm your credit score by using our search facility

Do you offer fast cash loans near me?

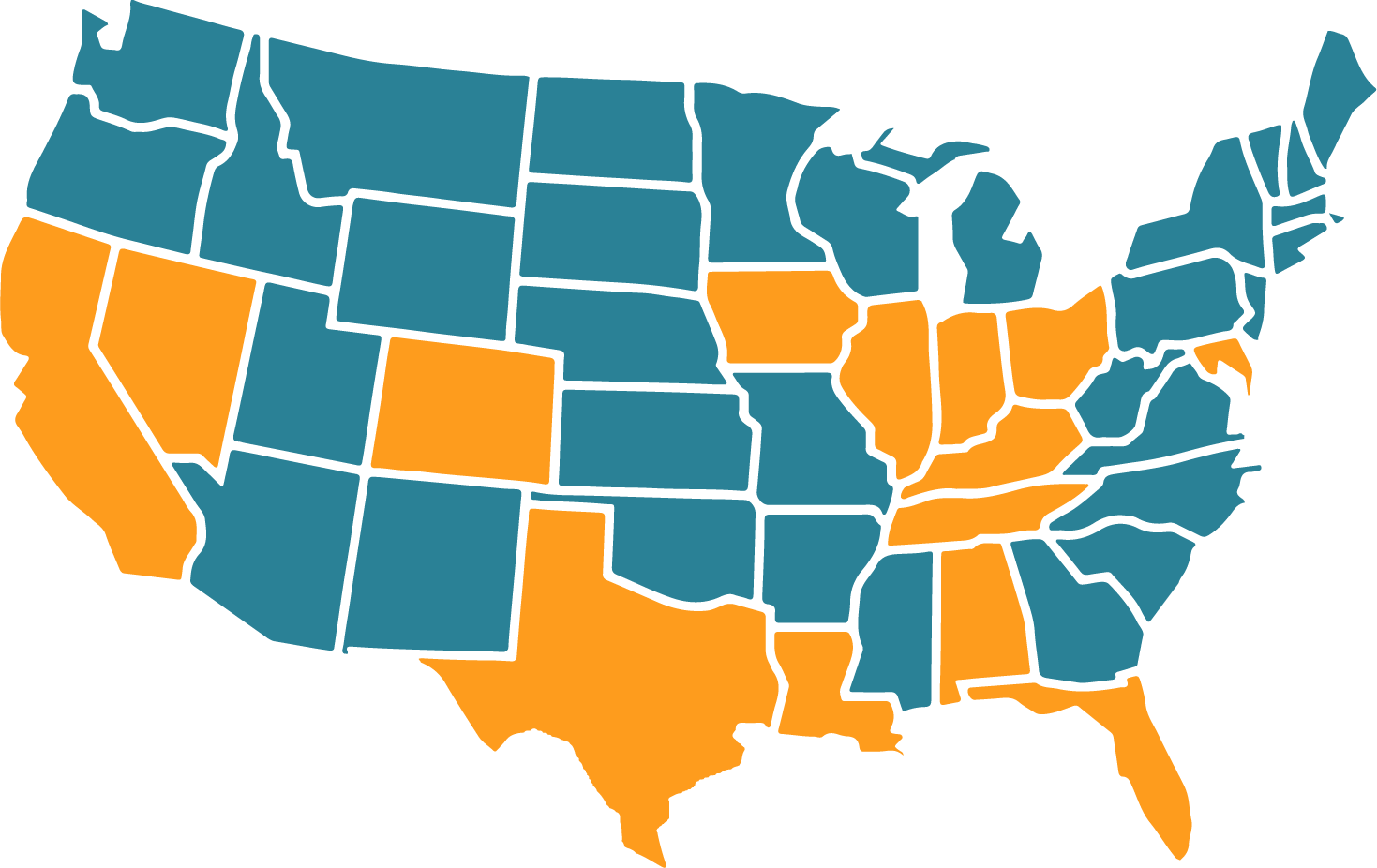

Loanza is ready to assist you with your fast cash loan search no matter where you are in the US. We operate online, so all you need to do is complete our form and we’ll do the rest. We have connections with reliable and trusted lenders throughout the States.

We focus on connecting you to the most suitable lender, so that could mean someone local to you or a lender who caters to people all over the United States, from Virginia to Florida. Just hit one of our search buttons to get started.

How quickly can I receive the funds for my fast cash loans?

Timing varies depending on different factors, but some of our visitors have gone on to receive their loan in around an hour! At most, you should receive your funds within 48 hours.

Many lenders understand the urgency with fast cash loans, so if you complete the form here with Loanza and check it for accuracy from the start, it could be faster than you think.

Making mistakes could lead to delays, so it’s worth spending a minute or two double checking everything. If successful, the lender will transfer the funds directly to your checking account, further speeding up the process.

Can I still request fast cash loans if I have a poor credit history?

Yes, it’s still possible to get a bad credit loan in these circumstances! We’ve put together a diverse network of lenders who cater to all kinds of people. Some focus on offering loans to people who have bad credit, as they look at other factors as well. If you can prove you’re able to afford the repayments, you’re in with a chance of finding a fast cash loan via Loanza.

Frequently Asked Questions

How much cash can I borrow?

Loanza could connect you to a lender willing to lend you between $100 and $35,000 for your fast cash loan. You may find you are approved for a different amount than the one you request, depending on various personal factors. Your ability to repay the loan and your credit score could be among them.

How long can I take to repay my fast cash loan?

You could repay it in just one month or take anything up to 60 months.

Can I clear the loan earlier than intended?

Yes, you can often do this, but some lenders charge a fee for doing so. This is an early repayment fee, so check with your lender before you clear the loan, as it could influence your decision on this topic. You may also find a lender puts a minimum term on the loan.

Are you a direct lender or a broker?

Loanza provides a service connecting you with direct lenders, rather than offering loans ourselves. We aim to speed up the process by connecting you with the most suitable lender in our network.

Do I need to pay for your service?

No, you won’t pay anything to use Loanza. We’re always free.

How will I make my fast cash loan repayments?

If a lender grants you the fast cash loan you’re looking for, you’ll make one repayment each calendar month. This occurs on the same day each month too, so you’ll always know when it falls due. Your lender would usually arrange to take the money after you’ve been paid.

What should I do if I find I can’t repay the monthly amount due?

Speak to your lender – that’s the most important thing. Many lenders would rather make alternative payment arrangements than see you fall into arrears that you hadn’t planned for. They will charge a late payment fee if you miss one, and it is also likely to harm your credit score. Bottom line? Speak to your lender and you might be able to avoid this.

How can I use my fast cash loan?

You might already have a reason in mind, since you’re in a hurry to get the cash, you need. Common reasons for fast cash loans include unexpected bills, car repairs, home emergencies, and other unexpected reasons. Always consider whether you really need a fast cash loan before requesting one.

Do I need to go through a credit check to get a fast cash loan?

Yes, you will likely find that the lender you request a loan from will conduct a credit check before agreeing to the loan. If anyone suggests they’ll grant you a no credit check fast loan, they’re not likely to be reputable lenders. Loanza only connects you to trusted lenders in this market, so use our service today to stay safe.

Our Latest Guides

Need to borrow money?

Contact us today to find out how we can help.