Repay Over 1 to 60 Months

Installment loans are designed to borrow money you need, and repay it over a longer period, such as 6 months, 12 months, 2, 3 or even 5 years. Get an installment loan online with Loanza, and borrow $100 to $35,000 over 1 to 60 months. You could get funded in 24 hours or the next business day. Whether you need money for an emergency or for some longer term plans, Loanza offers installment loans for bad credit, fair credit, good credit customers. Apply now below!

What are Installment Loans?

An installment loan is a loan that is designed to be paid back over a period of months or years. These repayments are usually equal amounts and paid on the same day each month. With Loanza, you can get installment loans from $100 to $35,000, and repay them in 1 to 60 months.

Am I eligible for an installment loan?

To apply for an installment loan in the US, you should satisfy the below eligibility criteria:

- You are at least 18 years old

- You are an American citizen

- Your monthly income is $800 or more

- You have a current account (needed for depositing your funds)

How to Apply for Installment Loans with Loanza

Getting an installment loan with us is fast and easy thanks to our three-stage process. It only takes 3 minutes and it’s fully online!

Apply Online

Fill in our online loan application form with your basic details in less than 3 minutes. We’ll search our wide network of lenders for a suitable fit.

Get a Decision

Get your online decision from a lender in an instant. Review your offer, and sign your loan agreement.

Receive your Funds

If approved, watch the funds land in your bank account the same day or the next business day!

I’m looking for installment loans near me. Can Loanza help?

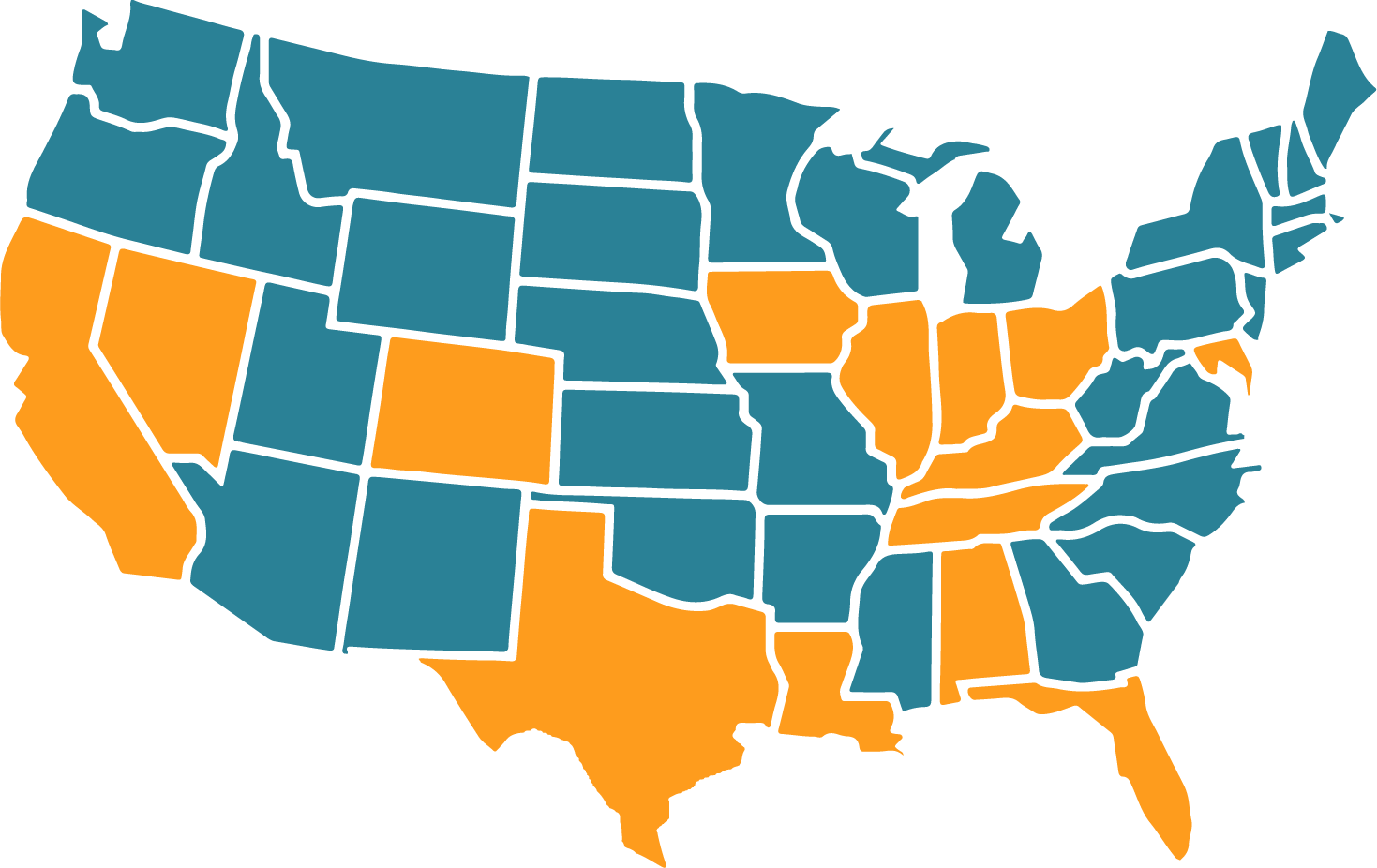

Loanza can help you find installment loans all across the United States. Our process is 100% online as well, so wherever you live in the US, you can find a loan via Loanza. We work with reputable lenders from California to Florida, and everywhere in between. Once you filled out our form, we can connect you to a suitable lender who can offer you the loan you need – this lender could be local to your state or a nationwide provider. You can get started with your loan search by clicking any of the buttons on this page.

Our Promise

Why use Loanza to get installment loans?

At Loanza, we have a network of trusted lenders, who can offer you an installment loan today. We could connect you with a suitable lender who can offer you the loan you need.

Loanza offers a quick and easy process, supported by our best-in-class technology. Fill our 2-minute form online and get connected with a lender who is ready to fund you.

- Our service is free to use

- Fast and simple online loan application

- Bad credit considered

- 24 hour or next working day funding

- Borrow $100 to $35,000

- We work with reputable, licensed US lenders

- Our loan search has no effect on your credit score

Can I get an installment loan with bad credit?

Yes, you can find a bad credit loan with Loanza! Our wide network of lenders offers loans to borrowers of all credit types, including those with bad credit history. Your ability to repay the loan is more important, than any credit mistakes in your past. If you have a frequent, stable income that allows you to afford your monthly repayments, you can get an installment loan via Loanza, even with bad credit or no credit history.

How fast can I get my installment loan?

Getting an installment loan may take between 1 hour to 48 hours, but you can count on getting your funds the next working day!

With Loanza, you complete one short form, and we search our network of lenders across the US. You will be presented with an instant decision on your screen, connecting you to one of our lenders who is ready to approve your request if everything adds up. So, be honest when you fill the form to speed up the process! If your application/request is approved/accepted, your money/loan amount could be in your bank/checking account in less than 1 hour, the same day or next business day.

Frequently Asked Questions

What can I use installment loans for?

Installment loans are typically used for unexpected expenses, such as boiler or car repairs, replacing appliances like dishwashers and washing machines and any other home fixes. They arre also used for other financial emergencies, like helping with existing debt, covering medical bills or vet charges, and so on. These reasons apply mostly for the shorter term installment loans. Those who take longer term loans often use it for paying for weddings, honeymoons, buying a new car, and so on. There s no restriction on what you can use an installment loan for, but we advise avoiding any type of loan if it’s not really needed.

How long can I repay my installment loan over?

You can take out an installment loan and pay it back over 1 month to 60 months (5 years).

Can I repay my loan early?

Yes, You can repay your loan early. If you want to do so, you’ll need to discuss it with your lender as there may be some conditions in place such as a minimum term, or an early repayment fee.

Are there any fees to search for installment loans?

Loanza is completely free to use, searching for an installment loan with us will never cost you anything.

Is Loanza a lender or broker?

Loanza is not a direct lender but a loan connection service. We can connect you to a direct lender that is most likely to approve your loan request.

Do you offer installment loans with no credit check?

Installment loans with no credit checks are nearly impossible to come by. All reputable lenders will carry out a credit check as part of their process to determine eligibility. However, you shouldn’t worry, because it’s only one element of the process. Many of our lenders specialize in bad credit loans, so your application will be considered.

Our Latest Guides

Looking for installment loans?

Contact us today to find out how we can help.