When Life Gets Tough, We Make Loans Easy

Small loans are available today via Loanza, for customers like you. You could borrow from $100 up to $5,000. You could receive a cash advance into your checking account within 24 hours or on the following business day. Get funded fast via Loanza – get started with our simple loan request form today.

How do I know if I qualify for a small loan?

If you want to request a loan in the US with Loanza, you must make sure you fit the following criteria:

- You are at least 18 years old

- You are a US citizen

- You have a stable and regular income to meet the repayments

- You have a checking account to receive the funds and make repayments from

How to get funded with Loanza

Getting a short-term loan with Loanza is simple thanks to our 3-step process. You only need 3 minutes to complete our online form.

Apply Online

Enter your details in our online form – it only takes three minutes!

Fast Process

Receive your loan offer on your screen in an instant, and review the lender’s terms before proceeding.

Receive Your Money

If the lender approves your request, you’ll get your cash advance on the same day or on the following business day.

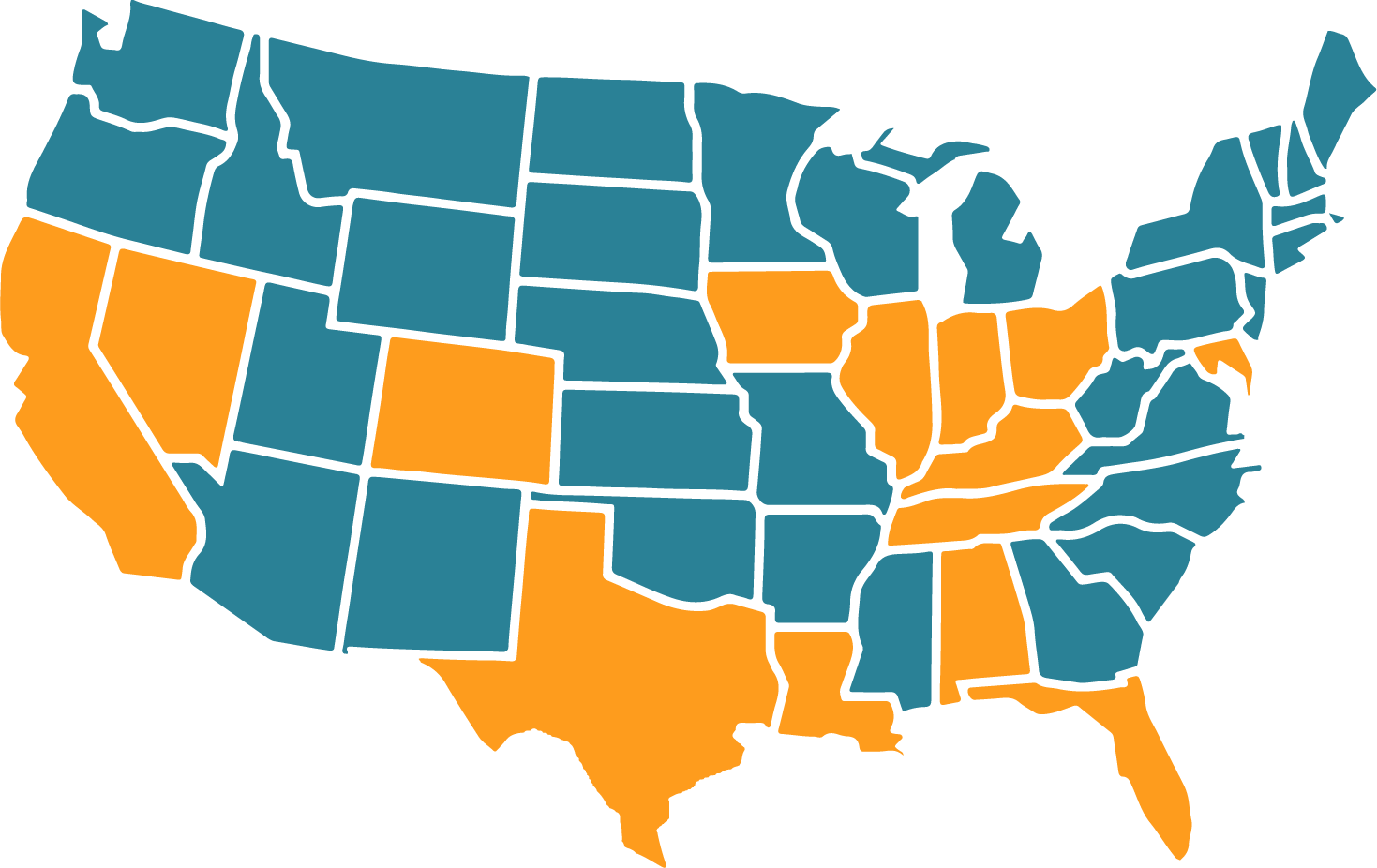

Does it matter where in the US I am based?

Loanza has connections to all kinds of lenders all over the US, providing cash advances to people who meet their requirements. From San Francisco to Pittsburgh, we’ll be able to find you a competitive cash advance with suitable terms from an appropriate lender.

All you need to do is to complete our straightforward form. Once that’s done, we’ll take over and search our collection of lenders to find you a suitable offer. Just head for our form via one of the links on this page to begin.

What makes Loanza the go-to place for small loans?

We act as a connection service, so you’re able to complete one form and we’ll do the rest, searching for the most suitable lender in our network of dozens of them.

With a fast online service, completed in just three minutes, we’ll guide you toward a suitable lender who can provide the cash advance you’re searching for.

- We’re completely free for you to use!

- Quick and easy online loan application

- Bad credit customers considered

- Get funded within 24 hours or on the following business day

- Borrow $100 to $5,000

- We only work alongside US lenders who are licensed, registered and trusted

- Our loan search will not harm your credit score

Frequently Asked Questions

How much can I borrow?

Loanza can connect you to lenders who may loan between $100 and $35,000.

How long can I borrow money for?

If you get a small loan, you could repay it anywhere between 1 to 60 months.

How can I use my loan?

Small loans are best used to cover expenses you weren’t prepared for. For example, a car breakdown and repair, an unexpected vet’s bill, or maybe a medical bill.

They’re not intended to cover anything frivolous you could spend time saving for, such as a vacation or even something cool you spotted in the sales.

Does Loanza offer loans without credit checks?

Don’t expect to be able to request a loan without a lender checking your credit history in some shape or form. It’s virtually impossible to do this – however, a soft check won’t harm your score.

Lenders need to look at your record to help figure out whether you meet their eligibility criteria. Don’t panic, though, as we have links to lenders who focus on providing bad credit loans to people who need them most. All requests are considered.

Are you a lender or a broker?

Loanza acts as a loan connection provider. We don’t directly provide loans, but we do have a network of lenders throughout the US, and we can help you find a direct lender best suited to help you.

Do I need to pay to use your service?

No, Loanza is totally free.

Can I repay my loan early?

Yes, you should find this is possible, but you should speak to your lender before attempting to do so. They might have terms that include an early repayment fee or minimum loan length.

How do I repay my loan?

You’ll make a repayment once a month for the term of the loan. Your lender will let you know the monthly date for the repayment before the cash advance is given. You’ll typically make the payment just after you get paid from your job each month.

What happens if I miss a repayment?

This may incur a late repayment fee. It’s also common for your credit score to take a hit, dropping from its existing figure. If you think you might run into problems making a monthly repayment on your cash advance, speak to your lender as soon as possible. This could give you a chance to make arrangements for a later payment that month without damaging your credit score.

Need to borrow money?

Contact us today to find out how we can help.