Repayment terms available from 1 to 60 months

Short term loans with Loanza are simple to apply for and convenient to pay back in equal monthly installments over 3, 6,12, 24, or up to 60 months. Fill our quick 3-minute online loan application form and borrow $100 to $35,000 with same day or the next business day funding. Bad credit borrowers are considered! Apply for a short-term loan below.

What is a short-term loan?

A short-term loan is a loan intended to be repaid over a few months. You’ll usually repay the same amounts each month on the same date. The lender will tell you how much the repayments will be and which date they’ll leave your checking account.

You could apply for a short-term loan for $100 to $35,000 and choose a repayment term of between one and 60 months.

What’s the criteria for short-term loans?

To request a short-term loan with Loanza in the US, you’ll need to say yes to all the following points:

- Are you at least 18 years of age?

- Are you a US citizen?

- Do you have a checking account to receive your funds into?

- Do you have a regular and stable income to afford your repayments?

How to get a short-term loan with Loanza

It’s easy to request a short-term loan online with Loanza. Our three-stage process is simple to follow and entirely online!

Submit your application

You can do this in less than three minutes thanks to our simple form.

Review your offer

It could take just minutes to receive a decision from a lender for you to review.

Get funded

Subject to approval, your funds could be with you on the same day or next business day!

Do you offer short-term loans near me?

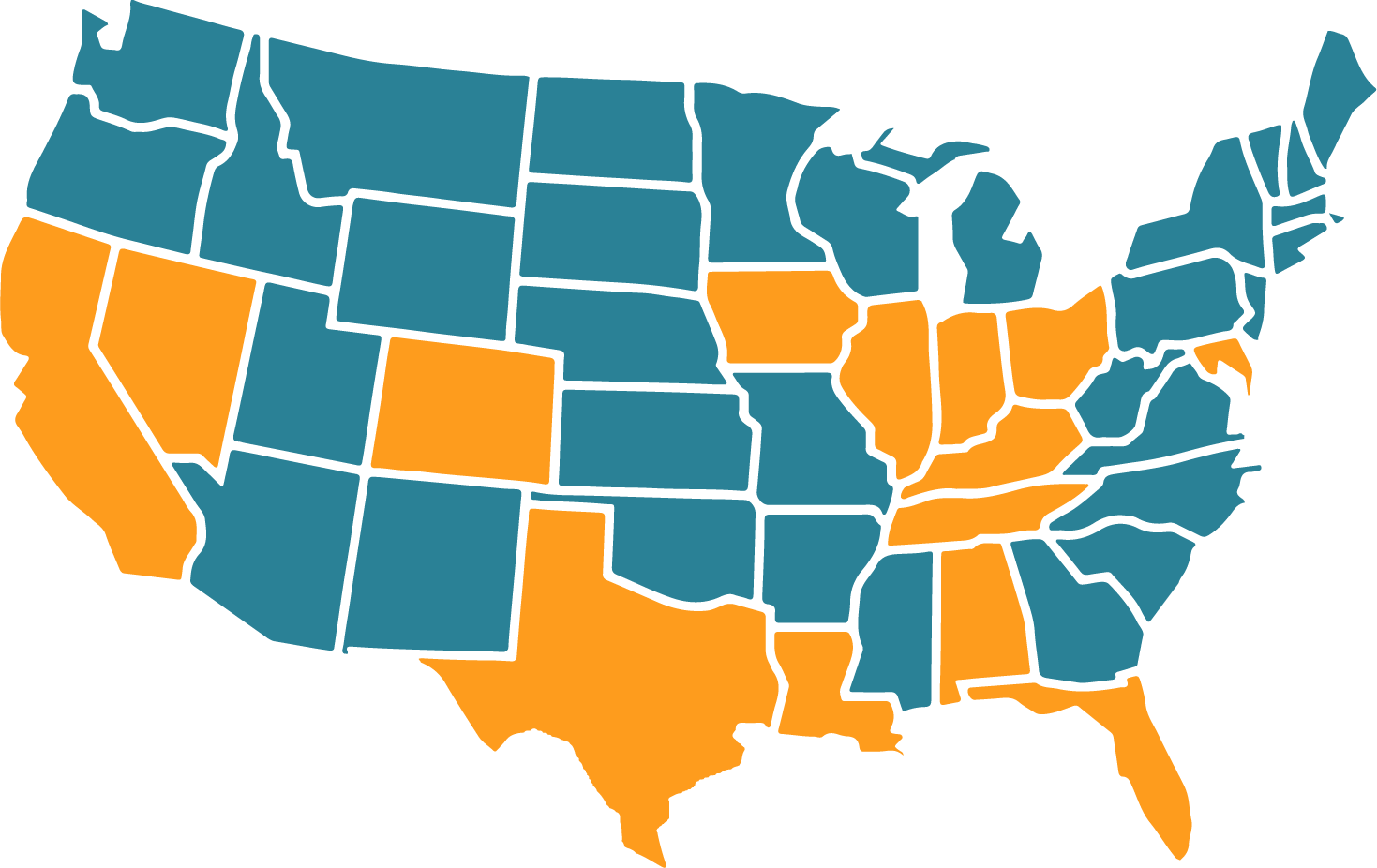

Loanza helps lots of people from all walks of life source short-term loans across the US. We’re connected to dozens of lenders across many states, from the east coast to the west coast, covering every part of America.

Upon completing our online form, we’ll connect you to a lender specializing in helping people near you or offering loans nationally. Click a button to get underway with your short-term loan request.

Our Promise

Why is Loanza a good choice to help me find short term loans?

We only use trusted lenders to source short-term loans for Americans looking for them. We could connect you to a qualified lender who could offer you a short-term loan. It only takes a few minutes to fill in our online form, too.

- Loanza is always free

- Quick and easy to apply online

- Poor credit? You’ll still be considered

- Funding within 24 hours or on the next business day

- Borrow between $100 and $35,000

- We only use licensed and trusted lenders

- Search for a loan with us and your credit score won’t be harmed

What can I use my short-term loan for?

No matter how well you plan your finances, there are often situations that can arise that may lead to financial problems. A refrigerator breakdown, car repairs, a bill you weren’t expecting… all these are among many reasons why someone might consider taking out a short-term loan.

Some people also consider these loans for other purposes, such as to consolidate debt and get a better interest rate by doing so. We do not recommend using a short-term loan for any unnecessary reasons such as buying luxury items or funding a holiday.

How quickly can I receive my short-term loan?

It could take anywhere from 1 hour to 48 hours to receive your short-term loans, with plenty of people receiving theirs on the next business day.

Loanza provides you with a simple form to complete online. Our fast service then searches our bank of lenders to connect you to one that is most likely to grant approval for your loan.

Honesty is best when you’re completing your form, as lenders will want to know your details are correct. If you’re accepted, your short-term loan could be with you in anything from under an hour to the next business day at most.

Is it possible to get short term loans with bad credit?

We’ve taken care to make sure we have a range of loans available from our lenders. Some consider requests from those with poor credit, and it won’t harm your credit score to search via Loanza.

Lenders look at whether you’ve got the ability to repay your short-term loan. If you can prove you’re earning a stable income and you’re able to meet your repayments, you should be able to find a suitable lender and the short-term loan you want.

Frequently Asked Questions

Is Loanza a broker or a lender?

Loanza doesn’t directly lend money to people. Instead, we act as a loan connection service. We’ll connect you to one of the lenders in our network that looks most likely to grant you the short-term loan you need.

Do I need to pay to use Loanza?

No, we never charge a cent for our services. You’re free to use Loanza to search for a short-term loan wherever you are in the US.

How much money can I borrow?

Short-term loans range from just $100 up to $35,000. Complete Loanza’s online form to find out whether you can borrow your desired amount. It depends on various factors, including your income and where your credit score is at.

How long can I take to repay my short-term loan?

You can take as little as one month if you opt for a payday loan, although many short-term loans are spread over a longer period. This could be 6 months, 12 months, or anything up to 60 months (five years) at most.

How would the short-term loans repayments work?

You’ll make a payment on the same date each month. You’ll agree on the date with your lender, but it often falls just after you receive your income from your job.

Can I repay my loan early?

Yes, it’s possible to do this but you should discuss the possibility with your lender first. They might impose a fee for clearing it ahead of the agreed date. Another possibility is that they’ll place a minimum term on your short-term loan, meaning you cannot repay it before that date.

What happens to my short-term loan if I can’t make a monthly repayment on it?

Most lenders charge a late repayment fee if you miss a payment. That’s why it is hugely important for you to talk to them if you know you’re not going to have the money to make your monthly payment. This could mean you’re able to come to an agreement with the lender to avoid the fee. Late payments can also cause damage to your credit score – and that’s something else you might be able to avoid if you speak to your lender.

Our Latest Guides

Looking for short term loans?

Contact us today to find out how we can help.