We help thousands of borrowers every day find loans for bad credit

Loanza’s bad credit loans are a great option if you have poor credit, and you need a loan. We can help you borrow between $100 and $35,000 and get funded in 24-48 hours (or the next working day). Repay your loan in 1 to 60 monthly installments. If you need cash fast, Loanza’s online application process is here to speed things up for you. We serve customers of all credit types – and that includes assisting those who have a bad credit history. Get started now!

What is a bad credit loan?

A bad credit loan is specifically designed for people who’ve run into problems with credit in the past. If you fail to repay a loan or make all the agreed repayments on time, your credit score is likely to take a hit.

This then leads to a lower credit score and potentially a bad credit history that could make it harder for you to get a loan. A bad credit loan is aimed at those in this type of situation.

Loanza could connect you with a lender who specializes in bad credit loans between $100 and $35,000, depending on your circumstances, with repayments spread over up to 60 months.

Do I meet the eligibility requirements for bad credit loans?

You’ll need to make sure you meet all the following requirements if you would like to go ahead and get a bad credit loan in the US with Loanza.

- You must be at least 18 years old

- You need to be a US citizen

- You should have a checking account to receive your loan

- You must have a reliable minimum monthly income of $800 to be able to afford your loan

How can I get a bad credit loan with Loanza?

Loanza makes it easier than ever thanks to our three-stage process – completely online and done in just three minutes!

Submit your information

Complete our online form and include all your basic details. It takes no more than 3 minutes.

Your loan offer

You could get a decision from one of our trusted lenders in minutes.

Receive your money

If you’re approved by the lender, you’ll receive your funds on the same or next business day!

Our Promise

Why is Loanza a top choice for finding a bad credit loan?

We’ve put together a range of trusted lenders throughout the US, many of whom deal with people who have less than perfect credit scores. When you complete your details, we’ll search for a lender specializing in bad credit loans for people like you.

- Loanza is and always will be free

- Quick to search for a loan

- Our lenders consider bad credit score customers

- Funds paid within 24 hours or on the next available business day

- Borrow between $100 and $35,000 depending on circumstances

- Licensed, trusted, and reliable lenders available

- You won’t harm your credit score by using our free search service

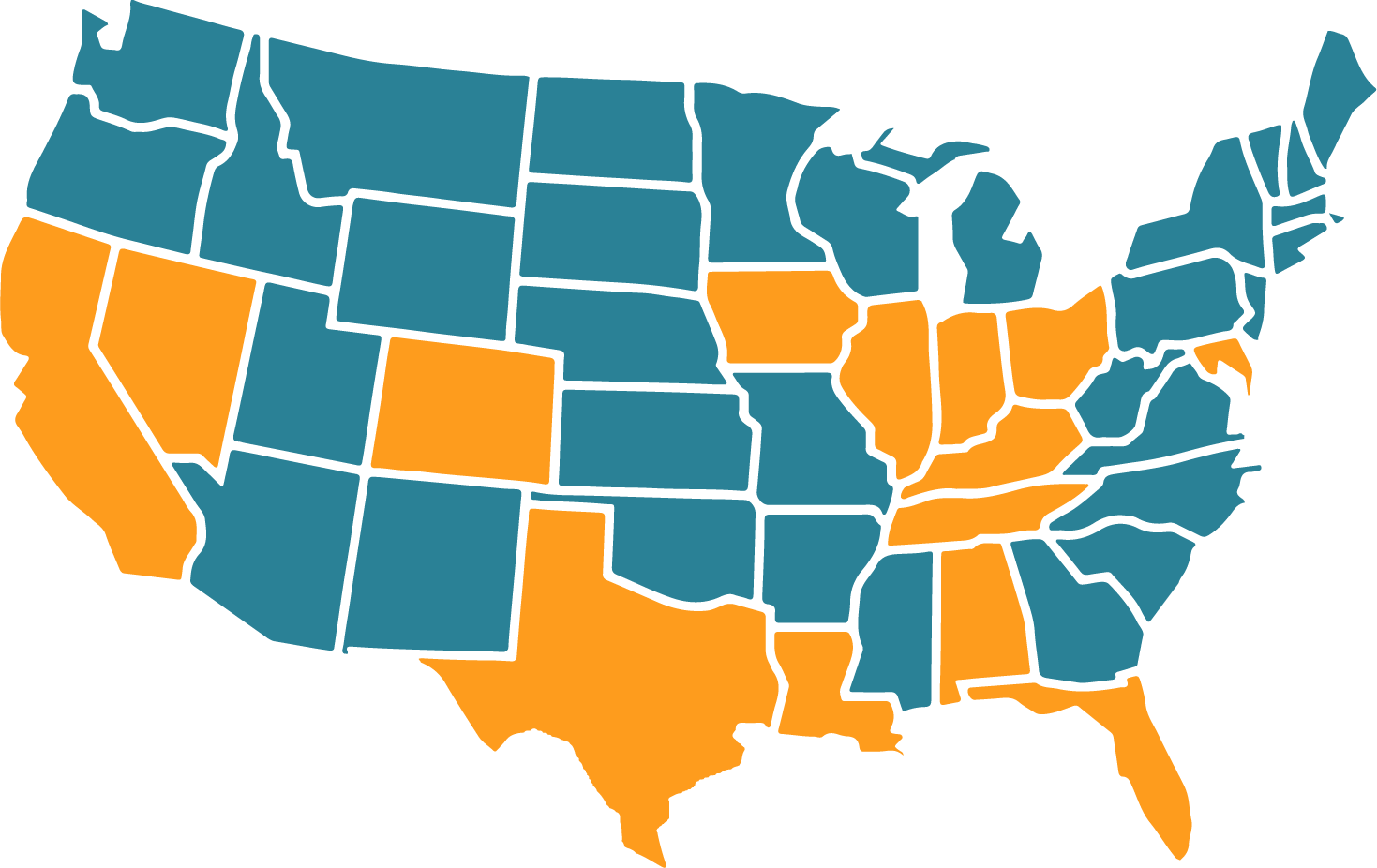

Do you offer bad credit loans near me?

Loanza works hard to connect people with reliable lenders based all over the United States. No matter where you live, from California to Florida and anywhere in between, you can hop online and complete our 3-minute form. Find out more about the possibilities for getting a bad credit loan!

Once you’ve completed the form, you can sit back while we search for a trusted lender, who focuses on helping people just like you. People whose credit score is lower than other lenders might welcome.

We’ll connect you to a suitable lender, whether that’s a local lender close to where you live or a national and trusted provider. Follow any link here to begin your search.

What can I use bad credit loans for?

Bad credit loans are created for people with bad credit who are looking for cash to help them meet emergency expenses, such as unexpected occasions where extra cash is needed.

Your washing machine may have broken down, for example, or your car needs repairs so you can use it to get to work and back. While there are no restrictions on how you can use a bad credit loan, we would never recommend that you use it for anything frivolous.

Can I get a bad credit loan with no credit check?

All reputable lenders will look at your credit history via some form of a credit check. It’s part of their process of considering you for a loan, and for how much they might lend you. The question could be whether this check is a hard or soft check.

Make sure you are aware of which one will be performed if you proceed with your loan request with the lender. We aim to connect you with specialists in the bad credit loan area, so you’ll be considered for a loan based on other criteria.

How long will it take to receive my bad credit loan funds?

It could take anything from an hour to 48 hours to receive your funds if you’re approved by one of our lenders for a bad credit loan. Most often, you’re likely to have your funds the next working day.

We’ve sped up the process for you by providing one simple form – online, easy to understand, and quick to complete. Check your details as you go, just to make sure you don’t make any errors that could slow things down. Honesty and accuracy go a long way!

If your request is accepted, your money could be with you in under an hour, or on the same day or following business day.

Frequently Asked Questions

Are you a broker or a lender?

We’re not a lender – instead we connect people with lenders, providing a connection between both parties. In doing so, we could link you to a lender most likely to grant your request for a bad credit loan.

Will you charge me for using your service?

No, Loanza has always been free to use and will always remain free. We do not charge any fees.

Will my bad credit history stop me from getting the loan I need?

No. Loanza’s worked hard to build a network of licensed lenders throughout the United States. With us, you stand a much better chance of finding a suitable loan in a few minutes. Begin to complete our online form now!

Lenders want to see whether you’re able to comfortably make the monthly repayments on your loan now. This means you need to have a stable monthly income. Even if you do have a bad credit history, it will not stop you from getting the loan you’re after.

How much could I borrow for a bad credit loan?

This depends on your personal circumstances, including how much you earn each month and your credit score. You could borrow from $100 up to $35,000, but a lender may offer a different amount to the one you request. It’ll depend on the information you provide and your situation.

How long can I have the loan for?

You can repay a small loan in just one month if you wish – as a payday loan. Other bad credit loans could be repaid over any period up to five years (60 months).

Is it possible to clear my bad credit loan early?

Yes, in most cases you should be able to do this. However, make sure you speak to your lender first. You may find they have a minimum loan term or charge a fee for early repayment.

How do the repayments work when I get a bad credit loan?

You’ll repay the same amount monthly, with your lender taking the agreed sum from your bank account. You’ll know the date in advance, and this won’t change. It should be arranged for a date just after you receive payment from your job.

What should I do if I realize I’m not able to make one of my repayments?

Whatever you do, don’t ignore it. Speak to your lender straightaway as it’s best to face up to the situation – and they may be able to help. In many cases, they’d rather make alternative agreed arrangements with you for that month, so you’re able to make the payment a little later than usual. Most importantly, this could prevent you damaging your credit score further – and save you from being charged a late fee as well.

Our Latest Guides

Looking for bad credit loans?

Contact us today to find out how we can help.