Apply for Payday Loans Online

Get Funded Today*!

If you searched for best payday loans near me, look no further, Loanza is here to help you find a payday loan for $300, $600, $1,000 or more. You can choose any loan amount between $100 and $35,000 and borrow it over 1 to 60 months.

Complete our online application in 3 minutes, and get connected to a suitable direct lender in an instant. Payday loans are available all across the US for customers with good, fair or bad credit, or even no credit check history. If you are approved, your payday loan could reach your account in 1 hour, 24 hours, the same day or the next business day from your application. Loanza’s service is completely free of charge, and will not affect your credit score. To get started now, just click the big orange button below!

*If your loan is approved, you could receive your funds within an hour, although this will depend on the lender and it can take up to three days for your money to be deposited into your account.

I’m looking for payday loans near me. Can Loanza help?

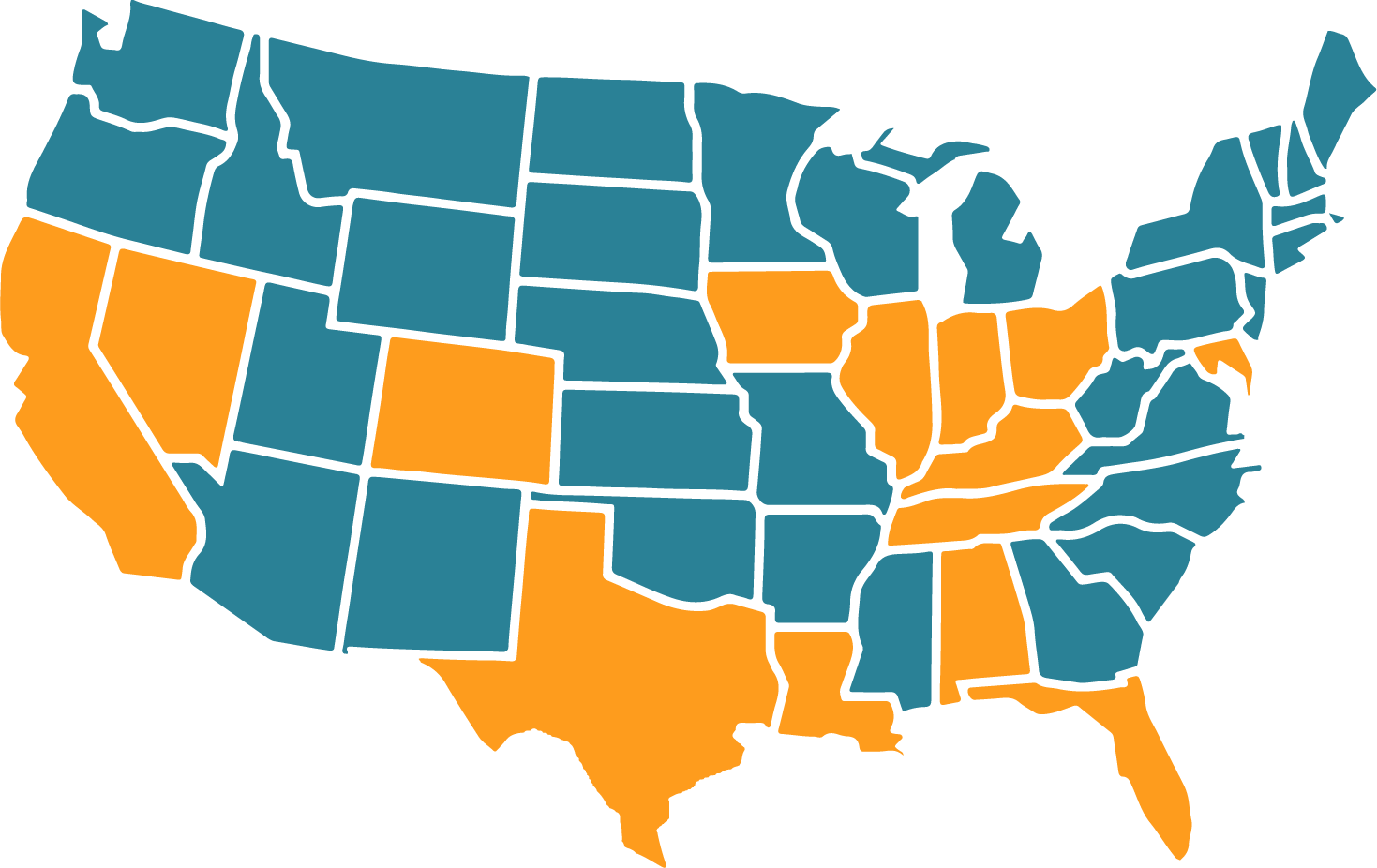

Loanza is happy to help everyone who searches for payday loans near me, as we offer payday loans in every state of the US where it is allowed to do so. Our best-in-class loan engine can connect you to a payday loan lender near you in a matter of minutes.

How to Apply for a Payday Loan Online

Step 1: Submit Application

Apply online by filling out our 3-minute online application form.

Step 2: Instant Decision

Get connected to a lender in an instant. Continue your application with the lender by signing your loan agreement

Step 3: Get Funded

If approved, your money could be in your account in less than 1 hour, but usually within 24 hours/same day or the next business day.

What is a Payday Loan?

A payday loan is typically used to help cover emergency expenses, such as a broken appliance or car repairs, or rent and bills that are due.

The loan is usually due two to four weeks after the application is submitted, and is normally repaid in full on the borrower’s next payday or when other income is earned, perhaps with a pension or Welfare Benefits. The payday loan agreement specifies the exact due date.

Payday loans are for small sums usually between $100-$1,000, and many states limit the amount of money that may be borrowed.

A usual loan limit is $500, however, there are limitations above and below this amount. With Loaanza, you can apply for a payday loan from $100 all the way up to $35,000 over 1 to 60 months.

Loanza’s Key Features

- Free of charge, no hidden fees

- Instant decision and fast approval

- 1 hour, same day, or next business day funding available

- Bad credit welcome, no credit checks considered

- Borrow $100 to $35,000

- Repay in instalments over 1 to 60 months

- Wide network of direct lenders USA

- Fully online application

What Do I Need to be Eligible for a Payday Loan?

There are only a few simple requirements to fulfil in order to get authorized for a payday loan.

- You must be over the age of 18.

- You must be a US resident.

- You should have a steady, consistent income of at least $800 each month.

- You should have a working cell phone and a current account (for your funds to be transferred into).

Apply for a payday loan with Loanza today if you tick all the boxes for the criteria above.

What Can I Use My Payday Loan For?

Payday loans are intended to help you cover short-term cash needs. You can use a payday loan to tie you over a few weeks or a few months when you are short on cash for necessities. You can borrow $100, $300, $500 or more, and pay it back on or shortly after your next payday in full, or alternatively, over a couple of weeks or a few months at most.

Some common reasons for taking out a payday loan:

- Emergency expenses

- Debt Consolidation (e.g. paying off credit card debt)

- Pay bills

- Car repairs

- Necessary household expenses

- Mortgage repayments

- Medical emergencies

- Clear overdraft

- Unexpected / inherited debt

Payday loans should not be used for non-essential things, such as:

- Luxury items or events

- Shopping for fun

- Gambling

- Investments

- Long term purposes

What Sort of Information Do I Need to Share When Applying for Payday Loans?

When you fill out our form, first and foremost, we will want to know how much you want to borrow, over how many months, and for what purpose.

We will then ask you for some personal details, such as your name, date of birth, address and contact details.

We will need some information about your monthly income (such as income source, frequency and amount). These are important for lenders to determine what you can afford.

We will also ask what your credit score is (no need to know the exact number, only whether it’s good, fair or poor).

However, as we mentioned before, a bad credit score is not a problem, so just be honest about it.

Then, to confirm your identity, you will need to share your social security number. You’ll also need to provide your checking account details, so your lender can use it to transfer the money you’re borrowing.

Don’t worry, your data is encrypted with 256 bit SSL (which basically means that it is safely kept and will not be compromised).

Be as honest and accurate about all these details as possible to increase your approval chances. If lenders find upon checking that the information provided was false, they may reject your application.

Since payday loans are unsecured, if the information you give is accurate, the process can be really fast and you can be approved and funded on the same day of application, depending on your lender.

Why choose Loanza’s payday loans?

At the heart of everything we do is our customers. This is an easy enough promise to make, but we back it up through our dedication to providing fast, safe, and personalised experiences.

We at Loanza are committed to responsible lending and have made great efforts to work only with reputable US lenders and loan providers who share this goal, so you can feel secure and supported in your borrowing.

Our best-in-class technology connects borrowers to direct lenders who are ready to offer them a payday loan. Bad credit, no credit check welcomed.

Our process is nice and simple, so you’re never more than a few minutes away from finding your loan offer.

Our service is secure, free, and has no effect on your credit score. Avoid going lender-to-lender to protect your score and get connected with a lender that is likely to accept your loan application.

Loanza helps thousands of customers find loan offers every day. Can we help you today?

Can we help you today?

Loanza helps thousands of customers find loan offers every day.

Can I Get A Payday Loan With No Credit Checks?

Payday loans without credit checks are more difficult to come by. Before accepting your loan application, most authorized and licensed payday lenders in the U. S. will have to do a credit check.

This will certify that, according to your credit history, you will be able to repay the loan without any issues.

However, as we said before, even if the lenders will run a credit check, they often consider other factors as more important in determining your affordability, such as your monthly income and employment details.

You can get your loan application approved by a trusted lender, even if a payday loan with no credit checks is unavailable.

When you apply for instalment loans or personal loans of a larger amount, you may be offered a secured loan.

In cases where you provide collateral to secure your loan against, such as your house or car, your lender will most likely make its approval decision based on said collateral’s value rather than anything else.

In these cases, you may even be offered a loan with no credit check.

Can I Get A Payday Loan With Bad Credit?

Yes, you can receive a payday loan even if you have bad credit – we deal with a variety of lenders that are prepared to accept all types of credit ratings and can provide you with suitable options.

You are not required to have an excellent credit score when requesting a payday loan online. Our lenders will consider other criteria such as your income, occupation, and the loan amount you have applied for.

All of these indicators can inform the lenders regarding your likelihood of repaying a loan, and they often weigh more in approval decisions than your credit rating.

Can I Get a Guaranteed Payday Loan the Same Day?

At Loanza, we can maximize your likelihood of approval by partnering with over 50 respectable lenders that will each thoroughly review your application – and we aim to connect you with the one that can provide you with the money you need, right away.

While we cannot guarantee a loan, we can surely boost your chances by bringing together a large network of lenders that are eager to lend. In most cases, loans are transferred the same day as the application. However, again, many times funding is available as early as the next business day and this will vary from lender to lender.

You can accelerate the process by providing accurate information when filling out our application form. Having a recent pay stub and bank statement at hand can help speed things up, too, in case your lender asks for proof of income.

You should also double-check you are eligible: you are over 18, you are a US citizen with a social security number, and you have a regular income and a valid checking account.

Try applying during working hours as opposed to bank holidays or Sundays for better chances of getting your loan in 24 hours.

Could I apply for payday loans near me?

Absolutely! Loanza operates in all states across the US where payday loans are allowed, so we’re definitely there when you search for payday loans near me. We can connect you with a trusted payday lender in your state.

- Alabama

- California

- Colorado

- Florida

- Illinois

- Indiana

- Iowa

- Kentucky

- Louisiana

- Maryland

- Nevada

- Ohio

- Tennessee

- Texas

If you don’t see your state here, don’t worry, we most likely offer payday loans in your state, too.

Even though regulations may differ state by state on loan amounts and terms available, the good news is, that wherever you are in the US, you can just fill in our simple 2-minute online form.

Based on your address details, we will aim to connect you with a lender in your state. There are no complexities with different loan application forms for each state.

Frequently Asked Questions

How much can I borrow with Loanza?

You can borrow between $100 and $35,000 with Loanza. Obviously, this means that you can request loan sums in the range, for example, $200, $2,000, $5,000, etc. The loan repayment period will be determined by the amount you borrow. This implies that if you need more money, you’ll need to take out a longer-term loan to ensure that your monthly payments are manageable.

How do repayments work for payday loans?

Repayments for payday loans are rather simple. You’ll normally pay back the full amount borrowed plus interest when you receive your next paycheck. This means, that payday loans usually only last until your next payday, so the loan term is around two to four weeks.

Loanza can help you find short-term loans also known as installment loans, that last from 2 months up to 5 years. If you are looking to borrow $1,000 or more, this is the type of loan offer we’re going to find you.

For both payday loans and installment loans, repayments can be collected automatically from your checking account. You will discuss and agree on the repayment dates with your lender.

This makes it easier for you to manage your repayments and less risky of forgetting or falling behind. Lenders often send you reminders of the upcoming repayment date and amount, too.

Are there any payday loan alternatives?

There are a few payday loans alternatives, and Loanza can help you find them, too!

Just a few scrolls above, we mentioned installment loans that last for longer periods of time. Many of our customers prefer these short-term loans over payday loans, as they allow for more flexibility.

You can take a loan out over 2, 3, or 6 months, and can borrow larger amounts to help you out in rough periods when a few hundred dollars just won’t cut it.

There are also small personal loans that we can connect you with if you are eligible. We have connections to car loan providers too if that’s what you’re looking for.

Before turning to Loanza, you could always see if you can borrow money from family or friends, too. If you’re lucky and they can help you out, you can avoid paying interest, and you won’t have to face consequences if you need some extra time to repay.

We’d advise you to first explore your options in your social circle. If you want to borrow money online fast, Loanza is here to help.

How much does a payday loan online cost?

The cost of a payday loan will depend on its annual percentage rate. This might sound a little funny since payday loans last only for a few weeks or months at best. Regardless, the APR determines the interest you will pay. Payday loan APRs range from 36% up to 5,000%.

5,000% sounds excessive, already 300% sounds like a lot, we know. However, when your loan period is only 1 month, the actual amount you need to pay back won’t seem too crazy.

Let’s look at an example:

Loan amount of $200 over 1 month. Rate of interest 272% (fixed). Representative 272% APR. The total repayment amount is $245.33 and the total interest is $45.33, equal to 1 monthly payment of $245.33.

It’s not too bad, is it? The annual interest rate may be high, and it would be if it applied over 12 months, but over a few weeks it cant be rather affordable.

I want to apply for payday loans direct lenders. Can Loanza help?

Absolutely. Loanza specializes in connecting prospective borrowers with suitable lenders. We have a large number of direct lenders on our panel to cater for customers from all walks of life.

Loanza’s high-tech loan connection tool can assist you in finding a lender that meets your requirements and parameters. You’re in safe hands because Loanza’s lending partners are all licensed, trustworthy, and respectable.

Our Latest Guides

Need to borrow money?

Contact us today to find out how we can help.